-

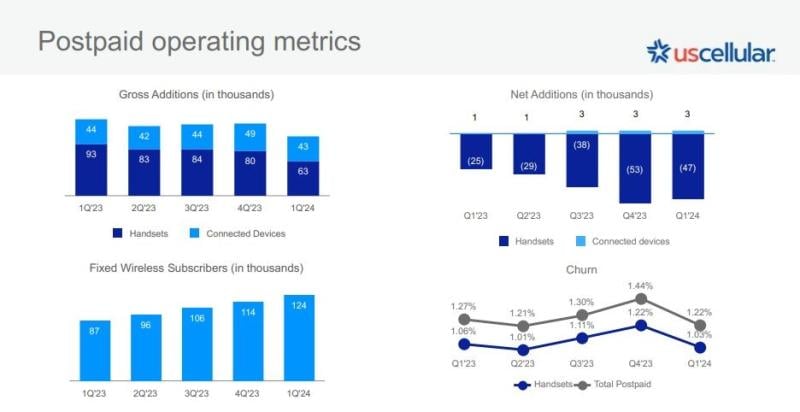

Customer losses continued, with net handset losses of 47,000

-

Cable companies’ bundles are hard to compete with when UScellular needs to invest in its own 5G network

-

The company didn’t comment on its strategic review other than to say that it’s ongoing

Things are not looking particularly good at UScellular. The regional carrier lost another 47,000 postpaid wireless phone customers in Q1 on top of multiple quarters of losses. And executives aren’t providing any updates on the potential sale of the company.

But as management tends to do in earnings calls, UScellular President and CEO Laurent Therivel today pointed to a few bright spots, such as higher ARPU. The company continues to move customers onto higher priced plans. At the end of March, it had 51% of handset customers on its top tier plans versus 42% a year ago.

Fixed wireless access (FWA) grew 42%, ending Q1 with 124,000 subscribers.

UScellular’s Q1 net income was $18 million, or 20 cents/share, lower than analysts’ estimates of of 25 cents per share. Operating revenue was $950 million.

Cable’s wireless blitz

The continued onslaught by cable into wireless is loud and clear. In February, Therivel blamed UScellular’s slowdown in gross adds largely on the rise of cable selling wireless in its markets. That hasn’t changed.

Indeed, Comcast gained 289,000 wireless subs in Q1 2024, now serving 6.9 million wireless customers. Charter Communications added 486,000 mobile lines in the same quarter, ending Q1 2024 with 8.3 million mobile lines.

UScellular, which is the fifth largest facilities-based wireless carrier, ended Q1 with a grand total of 4,051,000 postpaid wireless customers.

Slow progress

Therivel said that UScellular competes with cable’s wireless offers in about two-thirds of its footprint and cable could get even more aggressive in pricing and promotions in coming months.

Cable has the ability to bundle low-cost wireless with their fixed broadband products and offload an estimated 90% of their traffic to Wi-Fi, lowering their network costs and subsidizing bundles with wireline profits.

How does UScellular improve its prospects? Therivel said the path to positive net adds needs to be driven both by improvements in churn and gross adds. He’s pleased with the progress they’ve made in addressing churn, which was down “pretty significantly” in the most recent quarter. The postpaid handset churn rate was 1.03% in Q1 versus the previous quarter’s churn rate of 1.44%.

If you’re going to drive postpaid gross adds, “you have to get the network and the price equation right,” he said. One of the things that UScellular did in Q1, particularly near the end of the quarter, was more aggressive promotions and lifting trade-in requirements.

Another dynamic that is going to be increasingly meaningful relates to the business segment. The most interesting use cases in 5G are not targeting the consumer but businesses. UScellular has been investing in this area, which will help in the long run.

“Those 5G investments will be paid for much more with enterprise than the 4G investments were,” he said. “Mobile video paid for 4G. You’re going to need enterprise to pay for 5G.”

Tidbits

- The company is disappointed that Washington, D.C., didn’t find a way to keep the Affordable Connectivity Program (ACP) running. UScellular’s exposure is relatively minimal but it’s trying to serve affected customers with discounted offers so they remain connected.

- The mid-band 5G deployment is on track and they’re seeing a strong correlation between those network upgrades and customer satisfaction.

- UScellular shut down its CDMA network in January. At the time, it has 11,000 postpaid and 2,000 prepaid connections still using that network. Those customers are not reflected as defections or churn in the Q1 results.