AT&T has expanded its business cloud network solution partnership with Amazon Web Services (AWS), enhancing its role as an enabler of private connectivity to enterprise cloud services.

A key focus of this relationship is giving enterprise customers a secure connection to their cloud services through private connections that don’t touch the public internet.

RELATED: Nokia, Amazon Web Services partner to facilitate service provider, business cloud transition

"We can offer customers a highly secure, cloud optimized networking environment,” Roman Pacewicz, chief product officer for AT&T Business, in a release.

Multiple options

As part of its collaboration with AWS, AT&T is focused on four main areas:

FlexWare: AT&T is expanding the reach of how AWS customers can access the cloud more securely via its FlexWare platform. By making AT&T FlexWare cloud-ready, enterprises can directly—and more securely—connect to AWS.

Private Mobile Connect: As more customers increasingly rely on mobile technology to connect to their cloud applications when on the road or working remotely, AT&T Private Mobile Connect enables AWS customers to securely access AWS from a mobile device. Workloads are moved from the mobile device, via the public network or through NetBond for Cloud, to AWS for all customers.

Cybersecurity: AT&T Threat Manager will allow AWS customers to proactively identify data patterns and threat activity that could affect their network and cloud environment. The technology can process 5 billion security events in only 10 minutes. After analyzing the traffic in near real-time coming in and out of a device, connection or application, AT&T can then identify abnormalities to help prevent, detect and respond to vulnerabilities.

Internet of Things: Earlier this year AT&T introduced a dedicated IoT Starter kit, powered by AWS. The kit lets developers build their own solutions using AT&T IoT and AWS IoT. Developers can also use AT&T's network and get application-level security. Plans call for AT&T and AWS to bring AWS Greengrass to the AT&T FlexWare platform, which would enable edge computing to open new IoT opportunities for businesses.

Additionally, AT&T offers Cloud Transformation Consulting services. These services help customers select cloud solutions for their business. Customers can even have AT&T facilitate moving their data.

AWS continues to rise

While AT&T and other fellow telcos have shed some cloud service assets in recent years, this expanded partnership with AWS reflects the telco’s commitment to further enable its customers to get cloud connectivity. It also reflects the growing confidence that enterprises have in cloud providers like Amazon Web Services and Microsoft who worked to increase businesses’ confidence in moving data to the public cloud.

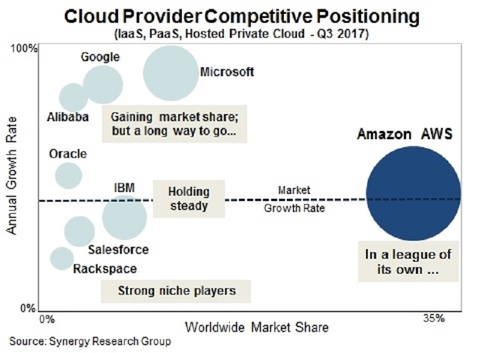

AWS, according to Synergy Research Group, continues to hold a dominant portion of the cloud services market. In its third-quarter report, Synergy Research Group revealed that AWS is consistently growing its revenues by over 40%.

Overall, cloud services continue to rise. Synergy estimates that quarterly cloud infrastructure service revenues—including IaaS, PaaS and hosted private cloud services—have now reached $12 billion and continue to grow at well over 40% per year.

“While we forecast 40% growth in the total market for 2017, there’s still something a little shocking about seeing a business unit the size of AWS consistently growing its revenues by over 40%,” said John Dinsdale, a chief analyst and research director at Synergy Research Group, in a release.

Dinsdale added that Microsoft, Google and IBM are also seeing steady uptick as well.

“Microsoft and Google too deserve plaudits for the growth rates they are achieving, while IBM is gaining market share in its sweet spot of hosted private cloud services,” Dinsdale said.