In its June 28, 2016 Special Access FNPRM (Further Notice of Proposed Rulemaking), the FCC declared that “best efforts [data] services do not appear to be a competitive substitute for BDS.” BDS is short for business data services with a performance guarantee, such as MPLS or direct internet access. This assertion ignores the reality of the emergence of the SD-WAN (Software Defined Wide Area Network) market that is poised to revolutionize the data connectivity market for businesses. SD-WAN creates a competitive substitute for BDS using best efforts data services.

Businesses are looking for more affordable, reliable, secure bandwidth to enable a significant shift away from closed, private networks to the open internet as a preferred network platform. As companies increasingly adopt web-based email systems like Office 365 in favor of internally hosted solutions, and as HR, CRM and even payroll have moved to hosted web services, the need for more bandwidth is becoming more urgent -- and all of that is before IT departments are cajoled into providing more bandwidth for YouTube and Facebook use at work.

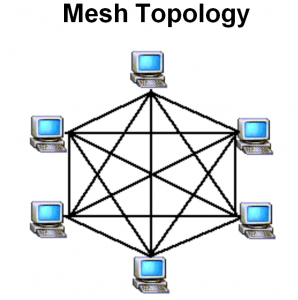

SD-WAN is taking software-defined networking principles and applying them to telecommunications networks. It is taking advantage of the significant increase in the availability of fast, cheap and reasonably reliable best efforts internet connectivity, and combining it with greater computing and routing power at significantly lower price points. By using multiple connections -- broadband, cable, LTE -- to create a massive Mesh-VPN with AES-256 encryption between all branches of the corporate network, SD-WAN offers a resilient and secure network at less cost than traditional solutions.

SD-WAN is also increasing operational agility by having pre-configured edge routers shipped to a branch location, which are automatically connecting to the network when power and Ethernet cables are plugged into the router. Some SD-WAN customers are reporting that they shift online more than 40 branches a night with only days of lead time, compared to four to six weeks’ lead time for traditional BDS services.

By having a central control panel in the cloud, network administrators can easily change policies, add new locations, and create VPN access for customers on the fly which, combined, give businesses unprecedented flexibility. In addition, network administrators can segment internally originated data traffic by applications and website even within https traffic that allows them to route the traffic over the desired connection.

Telecom providers such as Verizon and CenturyLink in the U.S., and SingTel in Singapore, are providing SD-WAN services together with a large number of other providers ranging from start-ups to industry giant Cisco to large and established companies such as Gap Inc -- which was featured in The Wall Street Journal -- with thousands of locations. Even a bank, one of the most risk averse type of client there is, has switched 3,000 of its branches to SD-WAN. One of the most successful SD-WAN providers, Viptela, is now valued at $875 million.

Market researchers like IDC project CAGR growth of 90 percent from 2015 to 2020, with global revenues of $6 billion. IDC’s view is supported by its own survey of its customers with nearly half of enterprises planning to consider moving to SD-WAN. Similarly, Garner predicts that by the end of 2019, 30 percent of enterprises will use SD-WAN products in all their branches.

Meanwhile, the FCC appears focused solely on driving any remaining profit margin out of BDS, rather than focusing on how it might encourage the proliferation of SD-WAN. Interestingly, SD-WAN is never mentioned in the FCC’s FNPRM purporting to assess the state of the market for data connectivity solutions. Let’s hope the failure to recognize the relevance of SD-WAN is not a sign the FCC doesn’t realize it’s an emerging solution and instead is merely a convenient oversight as the agency executes on its policy agenda for ISPs.

Roger Entner is the Founder and Analyst at Recon Analytics. He received an Honorary Doctor of Science from Heriot-Watt University. Recon Analytics specializes in fact-based research and the analysis of disparate data sources to provide unprecedented insights into the world of telecommunications. Follow Roger on Twitter @rogerentner.