The major headline is that 10G PON equipment is shipping in all regions and we expect NG-PON2 shipments by year-end. The minor is headline is contention around standards for the next upgrade. So why worry now about what lies ahead?

After all, new wireline access technologies need extensive testing before field trials even begin. However, widespread wireline access upgrades require low-cost ecosystems built around standards. Without standards, the ecosystem does not develop and without a robust ecosystem, CSPs delay deployments.

The major headline—10G PON is shipping and will dominate

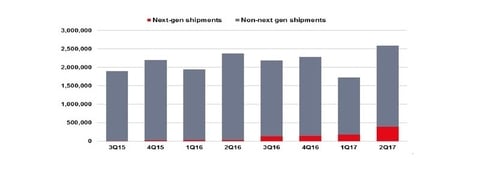

The 2nd quarter saw a major ramp in 10G PON OLT port shipments with next-gen PON OLT port shipments representing 15% of total shipments as shown in Figure 1.

Currently, 10G EPON OLTs are dominating the next-gen upgrade given significant shipments in China, followed by Japan along with minor shipments North America’s cable operators. This is not surprisingly since EPON network deployments are older, on average, than GPON networks in China. In Japan, most CSPs chose EPON and began deployments around 10 years ago. In NA, a number of cable operators have begun to deploy EPON networks for new housing developments, in competitive residential markets or for business services.

However, 10G GPON upgrades are beginning and over time, will catch-up and surpass 10G EPON. For example, we expect AT&T to begin deployments of XGS-PON (10G symmetrical GPON) before year-end. XG-PON1 (non-symmetrical GPON) shipments have begun in China and Europe.

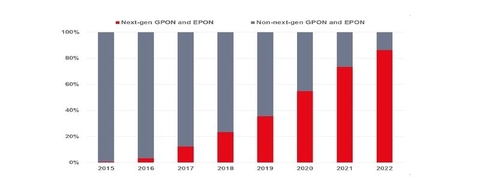

By 2022, next-gen PON, including 10G EPON and GPON and NG-PON2, will dominate, as shown in Figure 2 based on Ovum’s PON OLT transceiver (optical component) forecast.

Why next-gen PON now: the ecosystem is robust and low cost

The 10G PON ecosystem is well developed and complete, encompassing lasers, optical interface chips, PON MAC chips, equipment, and line test equipment. PON was developed as a fiber-based, mass-market access technology, which means low cost when compared to other solutions such as point-to-point optical networking. CSPs expect low-cost pricing even for 10G PON. CSPs expect to pay significantly less for 10G PON solutions than for 10G point-to-point optical fiber solutions. The ASP for a 10G optical networking port is around $3,000 today, compared to under $1,500 for an XGS-PON OLT port in North America or under $1,000 in China.

By 2022, the cost difference between an XGS-PON OLT port compared to a 2.5G GPON OLT port is around 2X. This provides easy cost justification for XGS-PON given its 4X downstream bandwidth and 8X upstream bandwidth advantages in addition to its ability to support higher-ARPU, nonresidential customers and applications.

Not every CSP is focused on 10G; NG-PON2 is alive and well

While 10G PON deployments and plans are under way by CSPs around the globe, one major CSP, Verizon, is focusing on NG-PON2. Verizon is not alone in its pursuit of NG-PON2, but it is open regarding its choice. NG-PON2, also known as TWDM PON, is based on the use of tunable optics. NG-PON2 is more expensive than fixed optics-based next-gen PON approaches, such as XGS-PON, but it has several key advantages. NG-PON2's multiple wavelength approach enables an operator to assign different subscriber types to different wavelengths, such as business subscribers to one wavelength and residential customers to another. Multiple wavelengths also support the wholesaling or unbundling of access networking, such as assigning a wavelength to another operator or virtual network operator. In addition, the ability to bundle multiple wavelengths supports the expanding bandwidth needs for MBH and FH (fronthaul). Verizon has plans to begin deployments late this year or in early 2018.

The minor headline—skip ahead to what comes next

In the meantime, both the IEEE and the ITU-T standards bodies have begun to work on the next-gen of PON, namely 100G PON. 100G PON would be based on 25G fixed optics, leveraging the 25G optics ecosystem from data center applications. There are discussions between these two standards bodies concerning convergence. Convergence would aid an operator such as China Telecom, who has deployed both EPON and GPON networks. Convergence would also aid the ecosystem - as vendors could focus on developing solutions for a single PON standard at 100G versus separate 100G EPON and 100G GPON products.

Complete convergence of EPON and GPON at 100G is unlikely in my opinion. Most CSPs involved in the standards committees are unlikely to invest the time and energy needed to converge EPON and GPON since they have respectively deployed either EPON or GPON.

So let’s settle for partial convergence at 100G

Ovum believes that partial convergence will happen at 100G, focusing on the PMD (physical media dependent) and MAC (media access controller) chips. There are clear R&D cost advantages for chip vendors around ASIC design and tape-out for supporting a single PON standard. In fact, many PON MAC chip vendors already supply "uni-PON" chips that support 10G EPON, XGS-PON, XG-PON1, 2.5G GPON, and 1G EPON. Optical chip vendors and optical interface chip vendors would also benefit from converged PON standards at 100G and this could lead to lower-cost components for the equipment vendors and consequently for the end customers, the CSPs.

Convergence at the higher levels is unlikely. EPON and GPON have historically different approaches to ONT/ONU device management and DBA (dynamic bandwidth allocation), for example. However, CSPs could influence more openness at these higher-level management levels by sharing their OMCI or OAM specifications. Verizon has plans to share its NG-PON2 OMCI specifications with the vendor community. By being open, Verizon hopes to reduce the amount of vendor proprietary software, which then supports equipment interoperability at both ends of the network—the central office and customer premises.

Next-gen PON after 10G will be divergent, encompassing NG-PON2, 100G EPON, and 100G GPON. Hopefully convergence will happen at the PMD and MAC layers along with openness around ONT/ONU management, a partial step toward the endgame of full convergence.

Julie Kunstler is a Principal Analyst at Ovum specializing in wireline/fixed broadband access, particularly next-generation broadband technologies, deployments and monetization strategies.