In his recent State of the Union address President Biden said all construction materials used in federal infrastructure projects — and he specifically mentioned fiber optic cables — must be made in America.

On its face, that sounds like a nice policy that even Democrats and Republicans can agree on. Unfortunately, sometimes there are no U.S. suppliers for certain components of fiber optic cables.

New Street Research policy analyst Blair Levin wrote today, “The Buy America policy, if strictly enforced, could cause significant delays in actual deployments.”

It would be ironic if one good goal of government — to buy American — negated another good goal — to close the digital divide.

The CEO of the Fiber Broadband Association Gary Bolton said, “This is a pretty sticky situation.”

Bolton said the U.S. Office of Management and Budget (OMB) has been taking comments on the Buy America mandate, and those comments closed last week. One thing it will be looking at is the percentage of any component that must be made in America. Currently, the threshold is 55% of a component. But OMB could move that threshold up or down.

What components are we talking about?

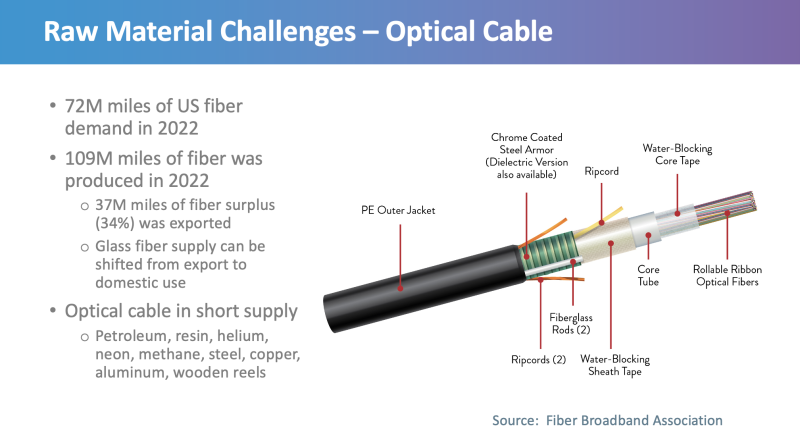

The Fiber Broadband Association (FBA) says in 2022 U.S. manufacturers produced about 72 million miles of fiber optic glass. This was produced by vendors such as Corning, Prysmian and OFS. Bolton said the fiber optic glass is not the problem in terms of Buy America. The U.S. actually exported fiber optic glass last year.

But fiber is more complex than one might think.

The fiber optic glass, which looks a bit like fishing line, is surrounded by coatings and support structures. These coatings and support structures use elements such as helium and neon and products such as petroleum, steel and resins that are often sourced from outside the U.S.

For instance, U.S. based Corning is a major supplier of the fiber cables that protect and organize the hair-thin strands of fiber optic glass. Last August, Corning announced it was building a new plant in Arizona “supported by AT&T and record industry broadband demand.” Corning already has two other manufacturing plants in North Carolina.

But even though Corning and others are making cables in the U.S., they probably have to source materials for those cables outside the U.S. “A lot of stuff comes from outside the country,” said Bolton.

He noted that there is other equipment necessary for fiber deployments too, such as cabinets, splitters, optical line terminals and optical network terminals. And even though there are American manufacturers for the electronics, such as Calix and Adtran, their OLTs and ONTs include chips, which are often manufactured in foreign countries.

Will the boom times continue?

Bolton said the fiber industry made great strides in 2022, passing 7.9 million homes with fiber. And it could pass another 9 million homes in 2023. In addition, the industry has closed lead times on fiber supplies down to less than 10 weeks. However, all this progress has been made without following strict Buy America mandates.

The ball is in OMB’s court right now.