Despite all the headwinds of supply chain and skilled labor shortages, there is increasing evidence that the massive, concerted effort to expand fiber and gigabit speed availability in the North American market is paying off.

First, OpenVault released its latest Broadband Insights Report (OVBI) which found that 15% of broadband subscribers were on gigabit tier plans in 3Q22, representing an increase of 35% from the same period last year. Further, the percentage of subscribers on plans between 200-400 Mbps doubled to 54.8% from 3Q21. Finally, the report also found that average monthly data usage was just below 496 GB, which was up 13.9% from an average of 434.9 GB in 3Q21 and up slightly from an average of 490.7 GB just a quarter ago.

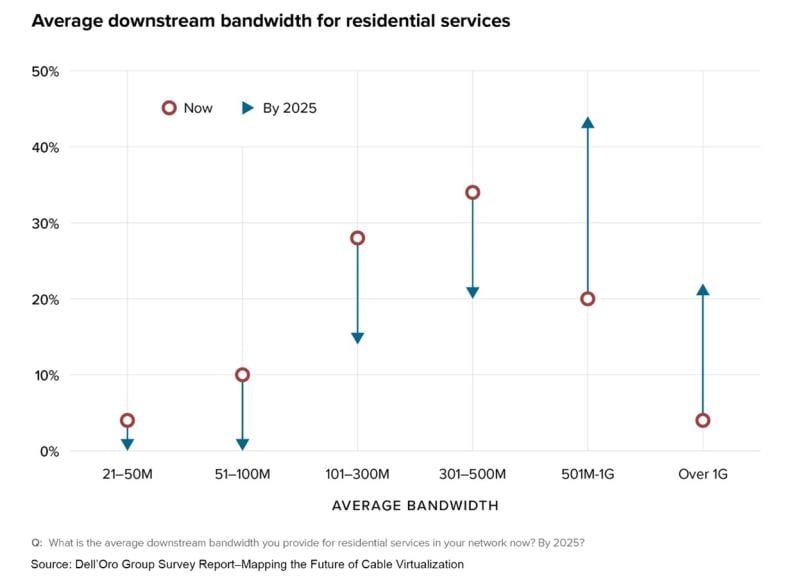

Interestingly, these results map closely to results we recently published in a survey of 50 global cable operators, titled Mapping the Future of Cable Virtualization. When asked about the average downstream bandwidth they offer their subscribers, 62% of respondents said they provide an average of 101 to 500 Mbps of downstream bandwidth today with an additional 20% offering downstream bandwidth of 501 Mbps to 1 Gbps. By 2025, 66% of respondents expect to offer an average of 501 Mbps to 1 Gbps+, in a clear acknowledgment that they need to keep pace with new fiber entrants.

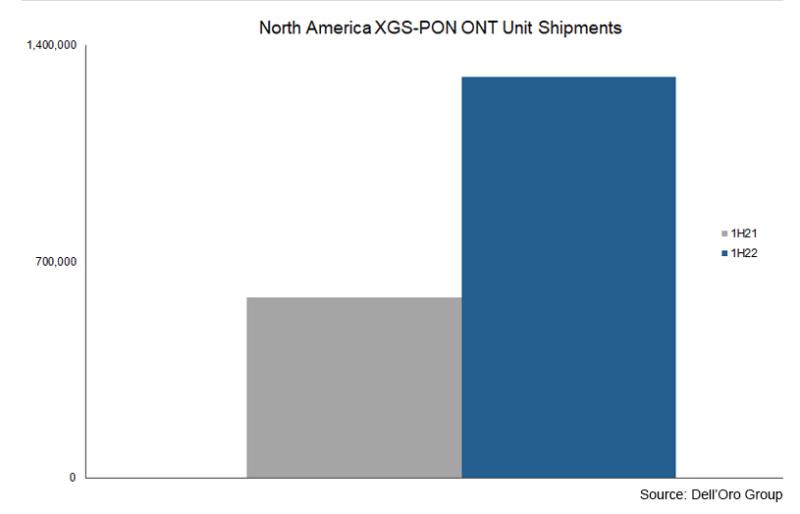

Not surprisingly, the growth in gigabit and near-gigabit subscribers has also fueled surging demand for residential CPE that can support gigabit service tiers. In a previous column, we pointed out the increasing demand for XGS-PON infrastructure. But ISPs can’t take full advantage of the additional bandwidth XGS-PON provides until they can get an optical network terminal (ONT) in the home. Throughout the second half of 2020 and all of 2021, XGS-PON optical line terminal (OLT) purchases were running well ahead of ONTs, as they typically do during large-scale buildouts. But in the first half of 2022, ONTs have caught up in a big way, reflecting the need for ISPs to offer a differentiated, premium broadband service as well as subscribers’ demands for those services.

Comparing XGS-PON Single Family Unit (SFU) ONT shipments in the North American market from the first half of 2021 to the first half of 2022 shows a dramatic increase from 583,000 units to just under 1.3 M units. We fully expect 3Q22 units to exceed the record number shipped in 2Q and probably do so by at least 10%. AT&T, Bell Canada, Frontier, Lumen and a growing contingent of rural co-ops, utilities and other ISPs are currently the primary purchasers. The goal for all of them is the same: Sign up subscribers for gigabit services today with a roadmap for multi-gigabit services which, for most subscribers today, remain pricey and perhaps a tad bit overkill. But that is the inevitable destination and being able to simply offer an upgrade to existing subscribers—with no need to swap out CPE—is a proven technique for reducing subscriber churn—just ask U.S. cable operators.

Speaking of cable operators: They are not idly standing by as they face the most challenging competitive environment they have seen in some time. Though they are seeing subscriber losses to both fixed wireless and fiber providers, they are also increasing speeds and offering upgraded CPE to subscribers while also spending a considerable amount of capex on mid- and high-split upgrades. Among those North American operators that report and segment their capital expenditures, spending on CPE through the first three quarters of 2022 has increased moderately over 2021. That spending is just now beginning to result in an increase in DOCSIS 3.1 units purchased in the second quarter (5.1 million units in 2Q22 vs. 4.8 million units in 2Q21), with additional increases expected in the remaining quarters of the year. The units seeing the largest increases are higher-end DOCSIS 3.1 gateways, especially those with 32x8 bonded DOCSIS 3.0 channels and 2x2 OFDM(A) channels in DOCSIS 3.1 mode, supporting 1 to 1.2 Gbps downstream. These units also are increasingly incorporating Wi-Fi 6E or, at a minimum, dual-band Wi-Fi 6 with more advanced antenna arrays.

These units, because of their advanced capabilities but also because of higher-priced components, currently carry higher-than-average ASPs, which is another reason for the increased capital expenditures among the region’s MSOs.

So, the gigabit race is clearly well underway in the North American market, with operators doing what they can to deliver on promised service offerings despite continued shortages in key components—particularly for consumer electronics, such as broadband CPE. Though CPE vendors are seeing an opening up of the supply chain, it isn’t enough to make any significant dents in their current backlogs. While gigabit service tier adoption continues to grow, the concern is that pressure on household budgets will result in a slowdown in broadband service upgrades. Currently, the numbers don’t suggest that is the case. But the fourth quarter will be telling.

In the meantime, ISPs are also increasing speeds and offering managed Wi-Fi services as a way to ensure loyalty. This dynamic of operators spending on the latest generation of CPE while overall subscriber growth and spending might be flattening is a sign that the competitive dynamic in North America has changed. 2023 will end up being a pivotal year for ISPs as they navigate a return to normal growth among an abnormally larger number of competitors.

Jeff Heynen joined Dell’Oro Group in 2018, and is responsible for the Broadband Access and Home Networking market, Fixed Wireless Infrastructure and CPE market research programs. He has expanded the Broadband Access and Home Networking areas to include fixed wireless CPE, virtual CCAP, Remote PHY, Remote MACPHY and DOCSIS 4.0 infrastructure. Heynen is a frequent judge and expert speaker at industry conferences and his research and analysis have been widely cited in leading trade and business publications.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceTelecom staff. They do not represent the opinions of FierceTelecom.