MoffettNathanson has put out some pretty negative reports on the future of cable’s linear video business. But a new report entitled “U.S. Cable: What is Embedded in Valuations?” is far more optimistic about cable’s broadband prospects.

Even though the last couple of earnings quarters have been brutal for cable companies, the analysts at MoffettNathanson say they believe the market is undervaluing cable’s growth prospects.

For a recap of the year so far, Charter’s stock is down 52%, Comcast is down 41%, Altice USA has fallen 66% and Cable One is down 53%.

But Moffett does an analysis that shows a big part of the stock drop can be traced to the current cost of capital. This is something that can change in the future and doesn’t go to the underlying prospects for cable’s broadband business.

Broadband analysis

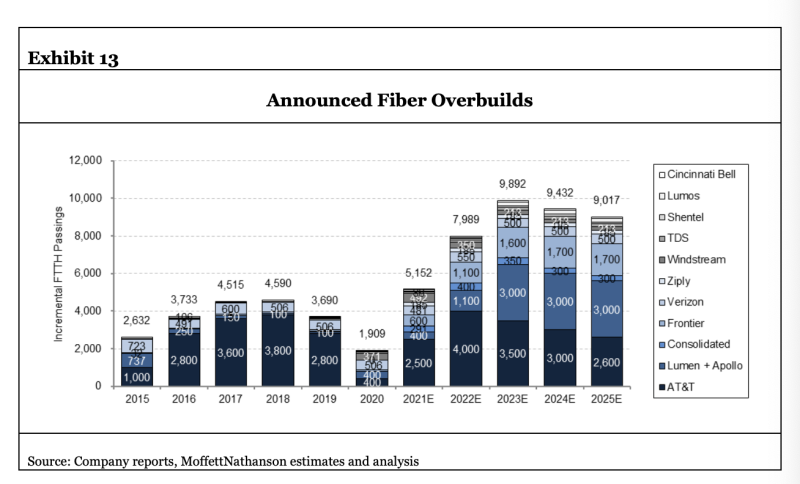

Obviously, cable is seeing new competition from all the fiber overbuilding, which is largely stemming from government programs such as RDOF and BEAD.

“For the country as a whole, a competing fiber network is available in roughly 38% of cable’s footprint, if you believe the current FCC’s deployment data. Over the next five years, that overlap is likely to rise to perhaps 58%, or twenty percentage points,” writes Moffett.

Based on its analysis, cable operators could lose 50% of their subscribers in 20% of their footprint. This would amount to a loss of 10% of their total broadband subscribers over five years.

But the remaining 80% of the incumbent cable operator’s footprint is either already fiber overlapped or is DSL only. In these areas cable can expect to grow its subscriber base – similar to all the other overbuilders.

On the negative side, fixed wireless access programs “will take approximately 3.5% of cable subscribers over five years,” estimates Moffett.

“In total then, based on this admittedly simplistic framework, one can expect something like zero to +1% growth,” write the analysts.

They also point out that some of the fiber overbuild plans are probably overly optimistic, given the extreme shortages of labor and equipment. And not all fiber overbuild plans are competitive in cable’s footprint.

Wireless is a bright spot

In addition to perhaps 1% growth in broadband over the next five years, it must not be forgotten that cable is now in the wireless MVNO business and has been doing very well.

RELATED: Charter, Comcast, Altice USA gain 694,000 wireless subs in Q2

“Using Charter by way of example, Charter’s wireless business now account for about 6% of revenues, and is now growing at a 40% CAGR,” writes Moffett. “That alone puts Charter’s total revenue growth rate above 2%. If their broadband business, which represents about 50% of revenues, can continue to be better than flat for subscribers and can continue to see 3.5%-ish broadband ARPU growth, then broadband will contribute another 2% to total growth, putting their total revenue growth above 4%.”

Other areas of cable companies' business must be taken into account as well such as business services, which are typically positive, and video, which is typically negative. But the net result is projected to be positive.