Accedian is acquiring Performance Vision, advancing its status in the growing network and application performance management (NPM/APM) segment.

Accedian did not reveal how much it is paying to acquire Performance Vision.

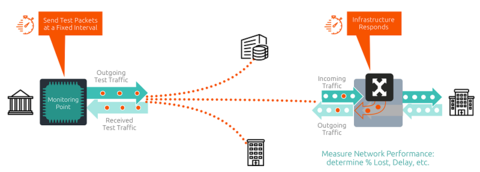

Performance Vision’s wire data analytics complements Accedian’s SkyLIGHT active monitoring platform, allowing customers to view all applications, transactions, and network components together, for a complete view of network health.

RELATED: SureWest employs Accedian Networks to ensure wireless backhaul performance

These tools provide actionable insight by analyzing all traffic crossing physical, virtual, cloud and SDN infrastructure to enable IT and network operations to improve end-user digital experience, application, network, and multicloud performance.

For Accedian, the acquisition not only complements its performance assurance portfolio with end-user experience monitoring capabilities for its existing customer base, but also expands its addressable market to key enterprise segments including banking, insurance, healthcare, manufacturing, and cloud services.

“One of the main motivations for the Performance Vision acquisition was to strengthen our enterprise portfolio,” said Scott Sumner, VP of strategy and communications for enterprise at Accedian, in an interview with FierceTelecom. “We have also enhanced our international presence in Mumbai and now in Paris, which is where Performance Vision is headquartered.”

Unlike other solutions, the new combined Accedian/Performance Vision platform is virtual. Accedian claims it unifies capabilities that other vendors must distribute in a variety of different products and solutions, reducing complexity and total cost of ownership.

Since it was founded in 2004, Performance Vision has built up a base of 400 enterprise customers, including KPMG, Orange, CGI, BPCE, and government organizations including the French Ministry of the Interior. Several of Accedian's partners also use the solution to provide IT services, while some host NPM/APM using software as a service (SaaS).

From a broader company perspective, Accedian’s acquisition of Performance Vision is part of an effort to increase revenue and expand into new markets and business segments in 2018. As part of this wider strategy, which includes the company’s expansion into the enterprise space, Accedian named two new members to its management team last month: Sergio Bea joined the company as vice president of global enterprise and channels, while Richard Piasentin took the role of chief marketing officer and chief strategy officer.

Gaining visibility

While plenty of monitoring solutions are on the market, the challenge is that most enterprises lack visibility into their network. The emergence of solutions from companies like Performance Vision also ties into the enterprise market’s transition to a cloud-based environment.

“The challenge for enterprises is the transformation of infrastructure toward SaaS cloud and hybrid cloud applications,” Sumner said. “As applications move into multiple clouds and interconnecting those hybrid clouds, which involve legacy components, are starting to strain in terms of their responsiveness and user experience.”

While many enterprises have told Accedian they are in various stages of virtualizing their networks, they often lack the knowledge of what’s running in their data centers. Oftentimes, enterprises don’t know what applications should be kept on or turned off.

According to IDC’s research, 92% of companies will deploy multicloud network infrastructure for applications. On average, a typical enterprise could be using three different private clouds and three different public clouds.

To address the tighter coupling of applications and the network, Accedian claims that integrating Performance Management’s tools into its broader package will differentiate it from other vendors that require customers to purchase point solutions.

“Our customers are telling us that applications and the network are becoming significantly more interrelated than they used to be because of the distribution of application components,” Sumner said. “A lot of solutions in the market today for visibility tend to focus on application performance management or network performance management, but there’s very few that bridge the two and allow you to see all the network and applications.”

Performance monitoring growth

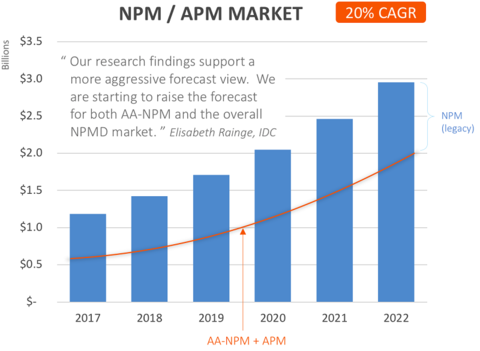

Growth in application and performance monitoring solutions is accelerating. A recent IDC report revealed that the Application Performance Management and Network Performance Management, which is a subcomponent of the NPM and APM segment, will be a $3 billion market by 2022. The research firm has raised the forecast for both AA-NPM and the overall NPMD market.

“IDC’s research showed that their own forecasts weren’t aggressive enough,” Sumner said. “There’s been an inflection point over the past year with a need to combine the application aware network performance market and is doubling our addressable market.”

When Accedian first looked at the enterprise APM opportunity, the concern was how big of a market it would be for the company. New research suggested that the interest level in NMPD from enterprises is nearly 70%.

“When we first looked at this market segment, we wondered if we can make money?” Sumner said. “A couple of studies revealed that there’s several greenfield enterprises that are just getting these solutions in place because their older solutions are getting old in the tooth in terms of what they can do in virtualized cloud environments.”