AT&T, CenturyLink and Verizon took a large hit in the broadband subscriber department in the second quarter, losing subscribers as their cable competitors saw gains.

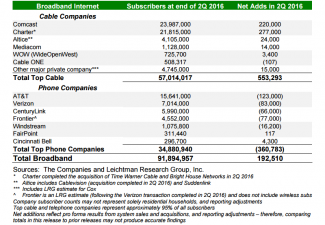

In all, the top telcos lost about 360,000 broadband subscribers in the second quarter of 2016, up from about 150,000 in the same period a year ago. Leichtman Research Group (LRG) noted in a new report that telcos have had net broadband losses in four of the past five quarters.

"While Telcos lost more broadband subscribers in 2Q 2016 than in any previous quarter, cable companies added over 550,000 subscribers in the traditionally weak second quarter," said Bruce Leichtman, president and principal analyst for LRG. "Over the past year, cable companies have added about 3.5 million broadband subscribers, while Telcos have had net losses of about 500,000 broadband subscribers."

The pain was certainly evident at AT&T, CenturyLink and Verizon.

At AT&T, the telco added a paltry 74,000 new broadband subscribers, including 20,000 new business broadband additions. AT&T ended the second quarter with a total of 14.2 million broadband subscribers, down from 14.4 million as it lost 110,000 broadband customers.

John Stephens, CFO of AT&T, told investors during its second quarter call that it expects “IP broadband net adds to bounce back in the second half of the year."

Verizon and CenturyLink also saw losses, but they were for different reasons.

At Verizon, a drop in FiOS broadband subscribers was expected, with the telco racking up a large backlog of orders during the quarter as it dealt with a wireline labor strike. The service provider shed 13,000 FiOS internet connections and 41,000 FiOS video connections, ending the period with a total of 4.9 million and 4.5 million FiOS subscribers. When taking into account DSL, the telco lost 83,000 customers.

CenturyLink, seeing an opportunity to capitalize on dual and triple play customers, dropped 65,000 subscribers, mainly broadband-only customers. As a result the service provider reported that its overall broadband customer base declined to 5.9 million subscribers as of the end of the second quarter.

But the pain wasn’t felt at just these top three providers.

Similar to CenturyLink, Windstream lost over 16,000 broadband subscribers during the quarter. However, the telco maintains that by upgrading its last mile networks with copper-based VDSL2 and vectoring as well as FTTH in select markets, it has an opportunity to win back customers and attract newer ones with higher speeds. The telco noted that more of its customers are purchasing 50 and 75 Mbps services in the markets where these options are available.

Alternatively, the top cable companies added about 550,000 subscribers in the second quarter, representing 139 percent of the net additions for the top cable companies in the second quarter of 2015. Cable broadband net additions were the most in any second quarter since 2008.

For more:

- see the release

Related articles:

Windstream sheds 16K broadband subs in Q2, but says speed enhancements break decline trend

CenturyLink bleeds 65K broadband customers in Q2, but says triple play focus will drive growth

Verizon drops 13K FiOS internet subs in Q2 due to strike impact

AT&T adds just 74K broadband subscribers in Q2, but expects year-end bounce back