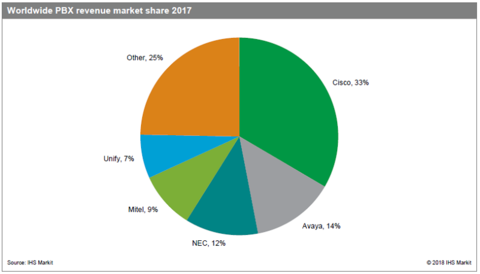

Cisco and Avaya may still hold dominant positions in the PBX market segment, but as enterprises put off spending and move to cloud-based service options, the on-premises PBX segment continues to struggle.

IHS Markit noted in its recent report that a decline in on-premises PBX licenses drove the global market to decline 8% in 2017 from 2016, to $5.7 billion.

Likewise, total PBX lines were down 9% year over year in 2017, with the research firm noting that every segment took a hit.

RELATED: Enterprise SBCs poised for growth as VoIP gateways are replaced, IHS says

“Many businesses are holding off on upgrades and new purchases, and the move to cloud services is having an impact,” said Diane Myers, senior research director for VoIP, UC and IMS at IHS Markit, in a new research report. “Underscoring the declines are not just slowing business purchases, but competitive pricing and the move to recurring expense models, which has resulted in market swings.”

While IHS notes that overall enterprise spending is “healthy,” businesses’ telephony upgrades and premises expansions are not top of mind. PBX average per-line revenue was $167 in 2017, up 1% from 2016.

Enterprises continue to migrate to IP—mainly to IP PBX—but the segment remains smaller than hybrid systems. IHS says that hybrid IP PBXs represented 64% of all lines shipped in 2017.

At the same time, business demand for unified communications (UC) has been “erratic over the past four years,” but the segment saw revenue rise 5% from the prior year. Led by Microsoft, which had 67% market share in 2017, the research firm noted that UC adoption is growing as more functionality is incorporated into PBX packages. Joining Microsoft were Cisco and Avaya.

However, IP phones (IP deskphones and softphones) were dominated by Cisco and Avaya with 35% and 14%, respectively.