As enterprises and small businesses look to simplify their telephony infrastructure they are increasingly turning to cloud-based hosted PBX and unified communications (UC) services that shift maintenance and upgrades to a third-party provider.

Initially offering a set of telephony-based products, more service providers are incorporating UC features into their service suite as additional businesses ask for more features beyond a simple PBX replacement service.

Diane Myers, senior research director for VoIP, UC and IMS for IHS Markit, said in a research note that she expects service providers to add additional functions to their cloud-based voice offerings as a way to upsell and retain customers.

“We look for providers to layer on additional functionality to maintain price points and create stickiness,” Myers said.

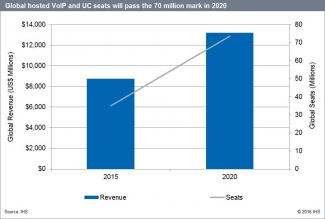

Given these factors, IHS Markit said it expects the hosted VoIP and UC market revenue to reach $13 billion and total 74 million seats by 2020.

Myers said that interest in hosted VoIP services is rising amongst not only small businesses, but also medium and large businesses.

“Hosted VoIP services have hit their stride owing to broad adoption among small, medium and large enterprises,” Myers said. “In particular, large enterprise activity has escalated over the last several years as more companies in this segment choose providers.”

But as the market continues to scale, consolidation amongst industry continues to rise, particularly in North America. Market participants are looking for greater scalability, infrastructure maximization and cost savings. During the first half of this year, over eight deals were completed, a trend that IHS market said they expected to continue.

For more:

Related articles:

Enterprise SBCs poised for growth as VoIP gateways are replaced, IHS says

IHS: Carrier Ethernet drops 2% in 2014, will grow slightly to $29B in 2019