FiberLight’s recent sale of fiber facilities to a regional cable operator raised speculation that it could sell off more of its network, but the service provider’s intent is to enhance its network capabilities in more profitable regions across its network footprint.

On Friday, the service provider completed its sale of fiber assets in Florida to regional cable provider Atlantic Broadband.

When Atlantic Broadband completes the deal with FiberLight, the service provider will add approximately 350 route miles to its existing South Florida footprint, doubling its existing fiber footprint in the region.

RELATED: Cogeco snaps up large portion of FiberLight’s Florida dark fiber network

Don MacNeil, CEO of FiberLight told FierceTelecom that the fiber sale made sense since the assets were more aligned with Atlantic Broadband’s needs.

“We did a large fiber indefeasible rights of use (IRU) agreement with Atlantic Broadband and they just wanted optionality to ultimately buy the South Florida and Miami network,” MacNeil said. “Given the fact that they are a cable overbuilder that Atlantic Broadband is a cable overbuilder and focus on residential and SMB that network was a better fit for them.”

MacNeil added that the sale gives the service provider to re-invest in its Texas and Northern Virginia markets—two of which the provider is seeing “significant growth.”

“For us, we have a big investment in Ashburn, Virginia and over the last several years Texas has started to explode for us,” MacNeil said. “If you look at where the growth is for us for infrastructure it makes sense.”

Virginia, Texas are growing

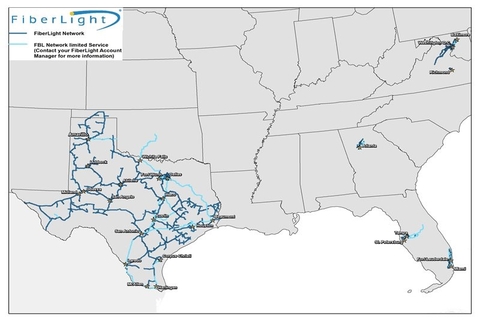

Virginia and Texas remain two of FiberLight’s largest fiber network markets.

Just last week, the service provider began an expansion project to enhance fiber connectivity between Washington, D.C., and Ashburn, Virginia.

By augmenting and supplementing FiberLight’s current network reach, this new construction will satisfy the growing demand for additional capacity to the Northern Virginia and D.C. metro area.

Upon completion, this new fiber network overbuild will enable FiberLight to provide customers with diverse connectivity and enhanced options to reach the world’s largest concentration of data centers in Ashburn, known as Data Center Alley.

“Our expansion in Ashburn really begins with right from the conduit up,” MacNeil said. “Depending on the different rings as we have them configured, we’ll be expanding the conduit as well as the fiber count.”

A key element of the Ashburn expansion is getting a permit from Loudon County to extend build its network along the Loudon County Parkway.

“The great opportunity is that traditional rights of way are congested so that was a big coup for us,” MacNeil said. “That will be the centerpiece and we’ll be expanding throughout Ashburn to meet the current and expected growth out there.”

Dallas, Texas, remains a big opportunity for data center connectivity.

“As much as Ashburn is growing, you’re seeing right on the heels of that a lot of data center growth in Dallas,” MacNeil said. “You’re also seeing in other parts of the country, companies like Toyota coming into Texas.”

At the same time, FiberLight not afraid of backing away of selling off or trading assets with other providers in Texas.

Today, the service provider announced that LOGIX will acquire nearly 400 route miles and over 5,000 miles of fiber from FiberLight in Dallas, Austin and San Antonio. These assets enhance LOGIX's scale in these markets and will greatly expand the company's reach to hundreds of new commercial buildings and thousands of potential customers.

Additionally, the two service providers will exchange about 1,500 fiber miles within their respective Texas footprints, allowing them to better address specific growth opportunities and accelerate their respective expansion activities within the state.

Atlanta shows potential

Texas and Virginia are only two growth geographies for FiberLight. The service provider is also seeing new potential in Atlanta, a city that is starting to grow its data center presence.

FiberLight can leverage and extend existing investments into the city to bring fiber to data center providers that need necessary interconnection within and between their facilities.

“Atlanta is cropping up as a great potential for data center business just because I would say the friendly environment for economic development,” MacNeil said.

MacNeil added that the lower electrical power rates are also making Atlanta more attractive to data center providers.

“The power rates are sub-5 cents and the fact that it’s clean natural gas power,” MacNeil. “Those are all strong characteristics for data center groups and another market we’re looking at, but we have nothing definitive planned at this point.”