Microsoft continues to enjoy a sizeable lead in overall software as a service (SaaS) revenues and it’s clear that the company’s dominance continued into the second quarter.

Having taken over the lead from Salesforce last year, Microsoft had already been growing its SaaS revenues. However, Synergy Research noted that Microsoft's acquisition of LinkedIn enhanced its SaaS business.

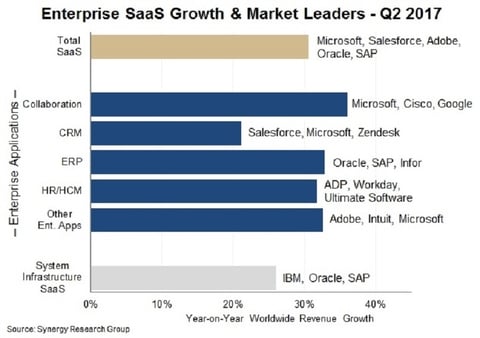

In terms of overall SaaS market rankings, Microsoft and Salesforce are followed by Adobe, Oracle and SAP as well as other large cloud players including ADP, IBM, Workday, Intuit, Cisco, Google and ServiceNow.

RELATED: Microsoft is becoming a key challenger to Amazon, says Synergy Research

Synergy noted that the SaaS “market remains quite fragmented, with different vendors leading each of the main market segments.”

Led by collaboration applications, the research firm revealed that second-quarter enterprise SaaS revenue grew 31% year-over-year to reach $15 billion in quarter revenues.

Oracle, Microsoft and Google were the major SaaS vendors that saw the highest growth rates during the second-quarter. However, Synergy said that SaaS spending trails on-premise software.

Synergy forecasts that the SaaS market will double in size over the next three years, with strong growth across all segments and all geographic regions.

“Traditional enterprise software vendors like Microsoft, SAP, Oracle and IBM still have a huge base of on-premise software customers and they are all now pushing to aggressively convert those customers to a SaaS-based consumption model,” said John Dinsdale, a chief analyst and research director at Synergy Research Group, in a release. “At the same time, born-in-the-cloud software vendors like Workday, Zendesk and ServiceNow continue to light a fire under the market and help to propel enterprise spending on SaaS.”