The advent of cloud-based and related services has created a ripe opportunity for optical vendors to pursue the data center interconnection (DCI) market—one that requires large amounts of bandwidth to exchange and deliver traffic and services to business and consumer end users.

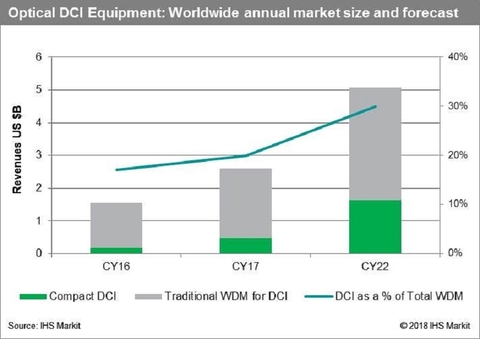

On a year-over-year basis, optical DCI hardware revenue grew by 26% globally, reaching $2.6 billion in 2017, according to IHS Markit’s latest market forecast.

But IHS says that the DCI market will surpass $5 billion in annual sales by 2022 and represent close to 30% of all WDM equipment spending.

RELATED: IHS Markit: 70% of service providers will deploy CORD in central offices by end of 2017

“The optical DCI equipment market experienced very strong momentum in 2017,” said Heidi Adams, senior research director of IP and optical networks at IHS Markit. “Moving forward we are forecasting continuing growth, as service providers, internet content providers and enterprises make additional investments to connect expanding and proliferating data center facilities.”

One of the key growth drivers inside the optical DCI market was the compact DCI transport equipment subsegment, which grew by over 200% in 2017 to reach $483 million in revenue. The research firm expects the compact DCI subsegment will continue to grow over time, as digital transformation continues at enterprises worldwide and as more and more content—including enterprise applications and video—is hosted and delivered via the cloud.

What’s also notable about compact DCI equipment overall is that it signals a broader industry trend toward optical equipment disaggregation. Simply put, optical disaggregation means that different functions in the optical network can be addressed by open hardware platforms and linked together through SDN controllers and applications.

Adam said that while DCI may be the first application for disaggregated systems, service providers will likely start applying the technology’s use in the metro and to deliver high-speed optical applications to business customers.

“As disaggregated equipment configurations get proven out in DCI applications, we can see usage expanding to address other areas in metro optical and enterprise applications,” Adams said.

OTN-free equipment takes charge

Optical transport network (OTN) may still have a play in the optical market, with hardware sales rising 4% in 2017 to $11.3 billion. While OTN switching is a large part of optical sales, the overall segment is on the decline.

IHS attributes the decline in OTN to the growing presence of optical DCI and the growing influence of web-scale internet content providers (ICPs) like Facebook and Netflix. Outside of the traditional carriers, ICPs have standardized on Ethernet as the preferred technology providing subwavelength aggregation and switching.

“With no legacy TDM traffic or connection-oriented services to support, the business case for introducing OTN services, OAM and/or OTN switching infrastructure is less apparent,” Adams said. “As a result, a new class of ‘OTN-free’ WDM equipment, optimized for the requirements of web-scale and data center operators, has emerged.”

P-OTS remains strong

While OTN may be on the downswing, the packet-optical transport system (P-OTS) segment is seeing decent growth. In 2017, P-OTS segment revenue reached $2.5 billion, up 10% compared to 2016. IHS said that as DCI becomes a more important application for optical networks, there will be a pull-through effect for P-OTS platforms. P-OTS has also become an attractive platform for two service provider services: DCI as a service or dedicated Ethernet and wavelength services for DCI.