Service providers’ transition to SDN is a two-part leap: migrating network infrastructure from a stagnant hardware-centric to a flexible software-centric architecture as well as driving vendors to work collaboratively on interoperable solutions. By mandating that vendors work together, service providers will get not only the lowest cost but also the best fit solutions.

AT&T, which has been one of the leading advocates of this approach, says the transition was initially a tough sell for its supplier base. The company's suppliers have long-standing intellectual property and products that they don’t necessarily want to share with competitors through interoperability.

“When we first started, it was a tough sell for the incumbent original equipment manufacturers (OEMs),” said Eddy Barker, AVP of technology design and architecture for AT&T. “If you look at Cisco on the Layer 2-3 side and Ericsson and Nokia on the access side, it took some work because some of those companies have a lot of intellectual property in these areas and I think a lot of them are heavily embedded now.”

Barker added that the telecom industry is still going to need that “integration and expertise to bring that stuff together and there may be parts of the ecosystem that will still be secret sauce.”

Aurelio Nocerino, managing director and next-generation enterprise services offering lead for Accenture, agreed, adding that this integration work will require systems integrators to take a more active role.

“This is part of a whole culture shift that’s happening during the transition to the programmable network,” Nocerino said. “Deploying virtual functions and interoperating with the operating system software (OSS) itself is part of shifting from a typical network equipment provider type of professional services to a systems integration project. There's many moving parts needed to provide integration services that connect the API with the orchestrator.”

Providers call for harmony

To compete for service providers' business in the virtualized network space, vendors are being told they need to cooperate with one another. That's a big change: Outside of standards bodies, hardware vendors tend to develop solutions individually.

CenturyLink, which has been implementing SDN in various parts of its network, said it has had to convince its vendor partners to work more closely with one another. About 60% of CenturyLink’s core network sites are running NFV and SDN services.

Bill Walker, director of network architecture and innovation for CenturyLink, said it and other providers are motivating traditional telecom vendors to get on board the interoperability train.

“We’re working with the traditional telco vendors that are moving into the NFV and SDN space, including companies like Ericsson, Cisco, IT vendors like HPE as well as the IT systems integrators,” Walker said. “They all understand if they don’t have an answer, none of them gets our business.”

Similarly, AT&T wants to see this interoperability in its last-mile network. As part of that push, the telco has been an advocate of open source initiatives such as ECOMP and more recently the development of VOLTHA (Virtual Optical Line Termination Hardware Abstraction). Meanwhile, fellow telco Verizon has spearheaded the development of the Open OMCI (ONT Management and Control Interface) specifications to ensure service providers don't get locked into proprietary interfaces.

AT&T’s Barker said that vendor interoperability is critical as AT&T moves forward with transitioning its last mile.

“In each technology area, you have seen interoperability mature at different paces: some come out of the gate very effective while other ones come out of the gate and there’s a proprietary piece that prohibits interop,” Barker said. “It’s up to service providers and their efforts through the standards bodies to make sure we keep a level playing field and that interoperability stays very important.”

Vendors get on board

Vendors are responding to service providers' calls for interoperable SDN-based platforms. Prayson Pate, CTO of Ensemble for Adva Optical Networking, says the movement of service providers mandating vendors to work with one another has grown in the past year.

“If you turn the clock back a year, you had vendors saying they are open, but you can get it all from us,” Pate said. “Now, the operators are saying that’s not what we want and that’s why you’re seeing vendors’ behavior change.”

In another twist, some vendors are being tasked with deploying their software to manage multiple platforms. For example, Adtran revealed as part of its recently signed contract with Australia’s nbn that it will also manage other vendor platforms. The vendor is deploying its multivendor distribution point unit management platform, an element of Adtran's Software-Defined Access approach.

While not revealing which other vendors it is working with for nbn's project, Tom Stanton, CEO of Adtran, told investors during the company's third-quarter earnings call that his company is “managing other people's elements, and it's our software that's leading the way.”

A growing group of hardware and software vendors are also developing interoperable platforms for the optical and data domains. New concepts such as optical disaggregation, which is the breaking down of optical equipment into its elemental functions, are gaining momentum.

For example, leveraging the SDN and optical expertise it gained from its acquisition of BTI Systems, Juniper recently released its new disaggregated optical line system that separates the optical line system hardware from network control software. Juniper’s TCX1000 Programmable ROADM solution, which is enabled by Lumentum, is a colorless, directionless, flex-grid ready programmable ROADM that allows service providers to upgrade to various high bit rate speeds—100G, 200G, 400G, and beyond—without having to upgrade line system hardware.

Heidi Adams, an analyst in transport networks at research and consulting firm IHS, said service providers and vendors are exploring many variations of optical disaggregation.

“One is separation of transponders/modems from the line equipment (e.g., ROADMs, amplifiers, etc.),” Adams said. “This requires interoperability between the different equipment types and enables network operators the advantage of not being locked into one equipment vendor. It is also expected to allow for more flexibility in equipment upgrade cycles, and to reduce capex costs.”

Other providers like Verizon have taken the so-called white box approach of developing a universal customer premises equipment (uCPE) concept. In May, Verizon named ADVA Optical Networking’s Ensemble Connector as part of its uCPE solution.

Verizon is using Adva’s Ensemble Connector as its network functions virtualization infrastructure on commercial off-the-shelf (COTS) white box servers. Adva’s Ensemble Connector’s zero-touch provisioning enables Verizon to drop-ship servers directly from the COTS supplier to the end customer.

“Verizon’s universal CPE program chose to have a strictly multivendor implementation with different suppliers at every level, which fit in with our approach,” Pate said. “What it does do is it raises all these places where there’s no specs or the specs are not clear or are invented as they go.”

Testing is key

As service providers begin the SDN transition, they will need to test how their multivendor environments work. Service providers can now test SDN elements not only in their own labs and networks, but also within the cloud.

A lot is at stake for service providers to test how services supported by a multivendor environment will work not only in the lab environment but also in the live network.

One issue is clearly financial. Service providers need to ensure that the vendor platforms they have invested in can work in tandem to deliver services that are going to create new revenue sources at a time when legacy services continue to decline. Secondly, the multiplatform environment will need to work in a way that won't disrupt other existing services or customers that may not have adopted virtual services yet.

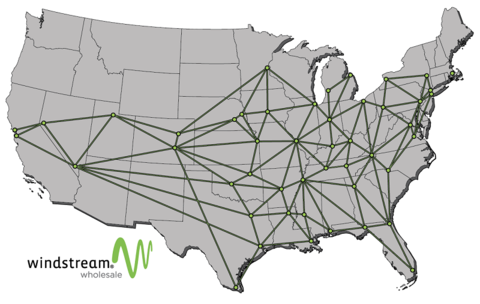

Windstream will hold a Proof of Concept (PoC) of its optical provisioning SDN capabilities during the upcoming MEF 17 event, for example. The carrier will leverage multidomain service orchestration, SDN controller software provided by the company’s vendor partners, and live connectivity to Windstream’s 150,000-mile fiber network.

The PoC will demonstrate end-to-end activation—turning up and down—of Windstream’s SDNow transport solutions of 10G bandwidth on-demand for carriers and enterprise customers. This service demonstration will show off how the platforms from the company's three main optical vendors—Ciena, Coriant and Infinera—can work together to enable the on-demand service environment.

“The demonstration is going to weave in some of the MEF’s lifecycle orchestration (LSO) concepts and it’s focused on Layer-1,” said Jeff Brown, director of product management and product marketing for Windstream. “It makes a lot of sense to try and control parts of the network you actually own.”

Other vendors and systems integrators are developing solutions to help providers test SDN implementations.

Accenture, for example, is using the Agile/DevSecOps methodology and the Accenture Cloud Lifecycle Automation Platform to support the development of the tools required for the automated testing and deployment of some key components of Open Network Automation Platform (ONAP). The company argues that its approach promotes collaboration among development, security and operations teams, and moves processes away from manual work and toward automation.

Other vendors like Amdocs, which worked with AT&T to develop the Enhanced Control Orchestration Management and Policy (ECOMP) platform that combined the Open-O effort to create ONAP, created a platform portfolio that features modular capabilities to accelerate service design, virtualization and operating capabilities on demand.

Amdocs' NFV platform leverages open source networking technology and can be deployed either locally or in the public cloud. Amdocs will let service providers test and verify virtual services on its ONAP open source platform.

“This is a hosting environment that will expedite the adoption of NFV,” said Tzvika Naveh, marketing director for NFV orchestration at Amdocs. “If you provide service providers and vendors the ability to take the virtual network functions and verify them, it will become the defacto standard.”

Vying for automation

By transitioning to interoperable SDN and NFV, the ultimate benefit is that service providers can automate service delivery and activation processes that have been largely manual. Service providers view automation as a way to be more agile while giving customers more control over how they interact with services.

Adva Optical’s Pate noted that automation was the talk of the town at the recent Layer123 trade show, for example.

“There was more focus on rolling out these virtualized services at scale,” Pate said. “The discussions have moved on from 'can we do it' to 'how do we do it at scale?' A recurring theme was automation and how the multivendor environments have to tie into the open source orchestration efforts.”

For many providers, the challenge is that network operations and management has been done using vendor-specific, proprietary Network Management Systems (NMS) that often did not interoperate with other vendor platforms. Telefonica, for instance, has deployed a different vendor in each region for its national transport networks. One of the problems associated with using this sort of NMS configuration in each region is that it can’t automate end-to-end provisioning.

AT&T, for one, noted in its third-quarter earnings call that the SDN transition is helping to curb costs in its business services segment, for example. The telco also recently introduced two new virtualization elements that are designed to automate operations and streamline service development: Acumos, an artificial intelligence (AI) platform, and a collaboration with IBM to create a microservices platform.

AT&T is hardly alone. Windstream, which just launched its SDNow optical service across its 50-state footprint, is working with its three main optical suppliers to transition its optical network to an automated one enabled by SDN.

“As we’re working with the vendors, they have been partnering with us in a collaborative fashion much more so than they would have done in the past working side by side with others they might see as competitors,” Brown said. “While we’re working with them, we’re also trying to demonstrate leadership in the industry and provide some guidance about the type of efforts we’d like to see out of the vendor community that will help us move to that programmable network.”

International incumbents like Telefonica are also taking part in such trials. In conjunction with its optical vendors—Adva, Ciena, Huawei and Infinera—Telefonica outlined its demonstration of an SDN architecture based on IETF’s Application-Based Network Operations Architecture (ABNO) framework, in a 2015 Optical Society of America paper (PDF). The service provider explored how to use an ABNO orchestration architecture with commercial SDN solutions from these vendors across multiple control domains, and the validation of Path Computation Element Communication Protocol extensions to support the setup of multidomain connections.

Masergy, which has implemented controllers to manage multiple devices from its vendor partners, is already seeing the benefits of automation from its deployment of SDN.

“We now have two pieces of software that go out there and one can read every device and another can manipulate and change the device,” said Paul Ruelas, director of product management at Masergy. “That’s how we’re able to give our customers that software-defined networking control to allow them to dial up bandwidth, change IP addresses, and add in routing information.”

In one case, the service provider enabled a customer that was affected by hurricanes in Florida to rapidly activate a second site. At this second site, the customer went to Masergy's site, plugged in the IP addresses and created an IPsec tunnel to that device that enabled them to connect to their corporate backbone.

“They were able to establish a quick disaster recovery site and without SDN in the network that never would have happened," Ruelas said.

The transition to SDN is far from easy, but the dialogue between vendors and providers is certainly changing. Vendors that want to participate in this new collaborative environment and reap the revenue rewards will have to realize a secret sauce attitude, or a one-stop shop is not going cut it.