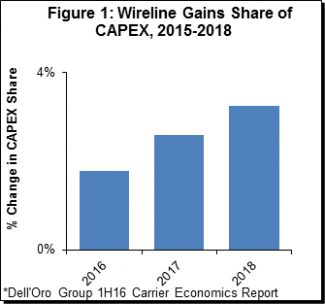

AT&T and other telcos' last mile and metro networks fiber builds are not helping to assuage wireless investment declines, according to a recent Dell'Oro Group report.

The research firm said that telco emphasis on wireline capex was not enough to offset declining wireless investments, adding that capex is forecast to decline at a faster pace than revenues over next three years.

“Given the state of carriers’ mobile networks and the asymmetry between mobile and fixed broadband coverage, penetration, and performance, carriers are increasingly shifting resources away from wireless towards wireline to ensure networks are ready for a more converged future,” said Stefan Pongratz, analyst for Dell’Oro Group. “Many of the developments that characterized the first half of 2016 will likely prevail in the second half of the year and will continue over the next couple of years.”

Pongratz added that “operators are aligning their investments with top-line revenue trends, which will continue to be impacted by slow growth in wireless.”

While new wireless growth engines will be hard to come by, Dell’Oro said that it is “optimistic” on the service provider community’s ability to curb the potential downside and projects capex will decline at a faster pace than revenues over the next three years. As a result, the research firm said that capital intensities will improve from 18 percent in 2015 to 16 percent in 2018.

For more:

- see the release

Special report: The top 12 wireline providers in Q2 2016: AT&T, CenturyLink, Verizon’s results marred by broadband losses

Related articles:

AT&T's $10B enterprise spending plan will deepen its SDN-based on-demand, cloud service footprints

Worldwide telecom capex spending to slow in 2016, says research firm