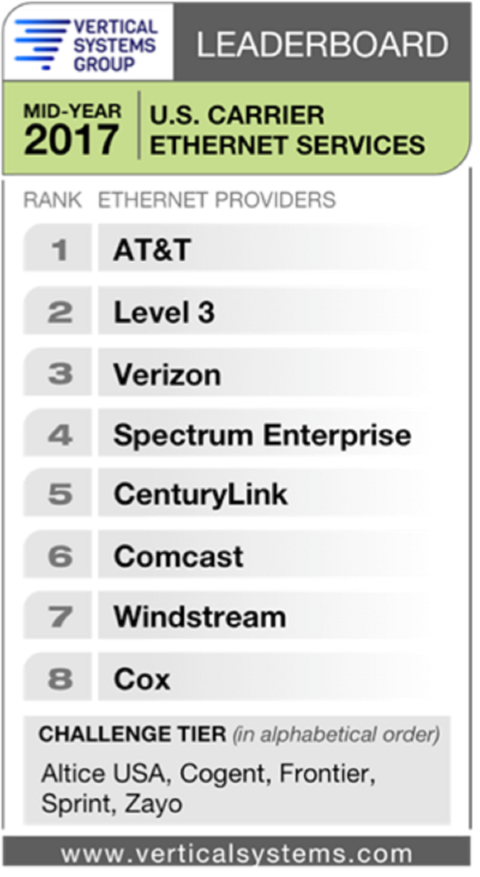

Verizon has advanced its standing as the third largest Ethernet provider, beating out Spectrum Enterprise on Vertical Systems Group’s midyear 2017 Carrier Ethernet Leaderboard.

Verizon's completion of its acquisition of XO Communications in February helped advance it on the analyst group’s list. XO was ranked seventh overall at the end of 2016.

By acquiring XO, Verizon immediately enhanced its metro and on-net fiber footprint. Specifically, the service provider gained metro networks in 40 major U.S. markets with more than 4,000 on-net buildings and 1.2 million fiber miles.

RELATED: From AT&T to Fatbeam: The top 25+ U.S. business fiber providers

Additionally, Verizon gained an intercity network that spanned 20,000 route miles connecting 85 cities. This greater capillarity of fiber immediately will enable Verizon to deepen its Ethernet footprint.

Joining Verizon on the leaderboard were seven other providers. While AT&T continued to hold on to first place, the telco was joined by Level 3, Verizon, Spectrum Enterprise, CenturyLink, Comcast, Windstream and Cox.

Rick Malone, principal at Vertical Systems Group, said that whereas the “pace of growth has slowed from the market ramp years, demand for Carrier Ethernet services remains very strong in 2017."

“The revenue and profitability outlooks for many providers are improving as fiber build outs are completed and pricing begins to stabilize.”

Frontier advances

While it’s been over a year since Frontier completed its troubled acquisition of Verizon’s assets in California, Texas and Florida, Frontier has been looking to establish itself as a more powerful player in the Ethernet market.

VSG noted that Frontier moved into the Challenge Tier, up from the Market Player tier. The Challenge Tier includes providers with between 1% and 4% share of the U.S. retail Ethernet market. Other Challenge Tier players include Altice USA, Cogent, Sprint and Zayo.

One of the key assets that Frontier brings to the table is its wider on-net building footprint. The service provider has more than 39,000 on-net fiber buildings.

Frontier can use the fiber network and its established set of fiber metro and on-net building fiber assets to deliver an array of Ethernet and VoIP capabilities for carriers and business customers. It is now part of a group of retail and wholesale fiber providers that have 10,000 or more on-net fiber-lit commercial buildings in the U.S., according to Vertical Systems Group’s new on-net fiber leaderboard.

However, the service provider recently said that it does not have immediate plans to purchase any other fiber assets to bolster its standings further.

“We feel good about the fact that we have 4.5 million households that we can serve with fiber and all the fiber that is in the network that enables a lot of the commercial opportunities that Ken Arndt’s team are going after,” said Frontier CEO Dan McCarthy during the earnings call, according to a Seeking Alpha transcript.

M&A will alter future standings

Mergers and acquisitions will clearly alter future standings on VSG’s upcoming Ethernet Leaderboards, a phenomenon that will play out further as more large deals are completed this year.

Take Spectrum Enterprise. While Spectrum Enterprise dropped from the third place to fourth place on the leaderboard, the cable MSO previously enhanced its own Ethernet standing over Verizon in 2016 when it completed its acquisitions of Bright House Communications and Time Warner Cable.

These purchases gave Spectrum Enterprise a large set of its fiber assets as well as an established base of external-network to network interconnection (E-NNI) agreements to satisfy off-net connections for multi-site business customers. With the Time Warner Cable acquisition, Charter gained 150,000 miles of fiber and 75,000 on-net buildings, along with 130 E-NNI agreements with 25 other service providers.

Likewise, the Bright House acquisition gave Charter greater scale across number of key vertical industry segments such as healthcare, hospitality, government and education and a broader Ethernet footprint with an additional 18,000 miles of fiber.

But another wave of M&A is coming that will also alter future Ethernet standings through the remainder of 2017 and into 2018.

CenturyLink’s pending acquisition of Level 3 will enhance the telco’s on-net and metro fiber footprint. The telco will increase its reach by nearly 75% to approximately 75,000, including 10,000 buildings in EMEA and Latin America, giving the telco a larger footprint to deliver Ethernet and software-defined services.

However, CenturyLink isn’t the only provider to watch on the M&A front. Now that it has completed its acquisition of FairPoint, Consolidated, for one, becomes the ninth largest fiber-based provider.

Consolidated now has a presence in 24 states and 8,000 on-net buildings. In acquiring these assets, Consolidated will be able to pursue more dark fiber and lit Ethernet business and wholesale service opportunities.