-

Telecom operators are a key target for cloud providers offering generative AI services

-

Less than a quarter of operators surveyed have adopted AI but that figure is expected to more than double over the next two years

-

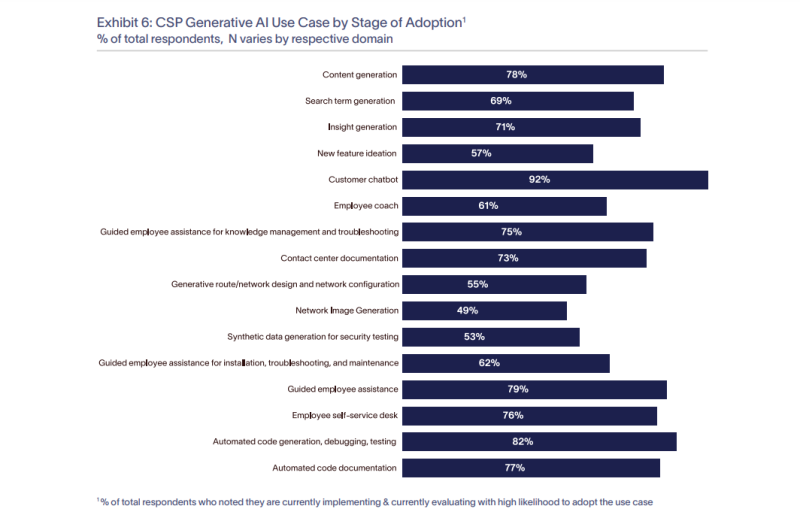

Chatbots are the primary use case today, but operators are exploring a number of other options

Just like its cloud competitors, Amazon Web Services (AWS) is leaning hard into artificial intelligence (AI). After announcing its cloud-based AI service Bedrock in April and testing it with customers all summer, AWS finally made Bedrock generally available last week. Given AWS has also homed in on telecom as a key vertical target, it makes sense that the company would want to know where communications service providers (CSPs) stand with AI adoption. So, they asked.

AWS hired consulting firm Altman Solon to survey 102 business leaders at CSPs across the globe. About half of these were in North America with the remainder a mix of operators in Europe and Asia/Oceania.

The survey report examined 17 use cases and found around 19% of respondents have already adopted some form of AI, with the most common use case being AI chatbots by a mile. But the adoption rate is poised to skyrocket to 48% over the next two years. And spending on AI, of course, is also expected to rise.

Here are some of the other use cases they’re evaluating.

Currently, CSPs are spending less than 1% of their total technology budget on AI. But 38% of respondents said they expect this figure to rise to between 4% and 8% of their total technology budget within two years. Another 37% said they expect it to grow but remain under 4% of their total tech budget in the same timeframe.

But there are some concerns and kinks in the pipeline that need to be addressed along the way.

For example, 61% of CSPs said they still have security, privacy and data governance concerns related to AI. And just over half (51%) said they lack the internal expertise to deploy and manage generative AI tools.

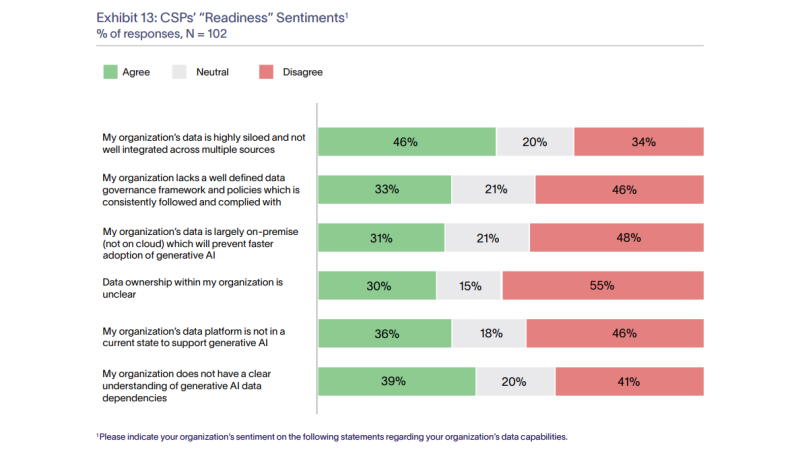

AI models, of course, rely on data. Security and privacy concerns aside, putting that data to work can be a problem for CSPs. Nearly half (46%) said their internal data is highly siloed. Here’s a snapshot of the full data picture based on CSP responses:

So, what’s the takeaway from all this?

AWS, Microsoft and Google Cloud may all be chasing AI and the telco market, but in order to achieve broader adoption of the former in the latter, cloud providers need to work hard to earn CSP trust and demonstrate that their data will be safe and the AI will be reliable.

We’ll be watching to see how well they do so.

Want to discuss AI workloads, automation and data center physical infrastructure challenges with us? Meet us in Sonoma, Calif., from Dec. 6-7 for our Cloud Executive Summit. It's going to be a blast!