It’s clear that the telecommunications industry is undergoing a challenging digital transformation. With the cost to expand and maintain infrastructure climbing and services revenue growth slowing, the industry is increasingly looking at AI and other automation technologies to cut costs and boost productivity.

Not only do telecom companies have some of the largest, most capital-intensive installed bases in the world, but they are increasingly competing with deep-pocketed hyperscalers and digital media companies who have their own networks to launch digital services. The industry needs a new competitive edge, and they see AI as part of that story.

NVIDIA’s survey backs up the need

In steps NVIDIA – again. A new survey of the telecom industry from NVIDIA indicates that telecom executives are keen on the potential for AI to help them. More importantly, they see the technology as potentially having a direct ROI that can solve challenges to both the bottom line and balance sheets.

Some of the key opportunities, according to the survey:

- The industry is embracing generative AI

- Telcos see customer experience as the biggest opportunity for AI

- AI is already improving revenues and cost savings

Challenges:

- Skill shortage is a major challenge to adopting and implementing AI

- AI investment has a limited budget

- Many respondents report difficulties in qualifying the ROI of AI

Let’s take a look at some more of the results of the survey.

Awareness and interest is growing

The main takeaway is that there is a sustained interest in adopting AI to help solve the problems of automating and improving services, especially among industry executives. In the 2023 survey, 90% of respondents reported they were currently engaged with AI, either at the assessment/pilot stage or at the implementation/using stage. Of those surveyed, 56% said that AI would be important to the company’s success. That figure rises to 61% among decision-making management respondents. That result is 14% higher than the 42% result in the 2022 survey.

There also appears to be growing confidence that AI will help the industry’s competitive advantage in the market. In the 2023 survey, 53% of respondents agreed or strongly agreed that adopting AI will be a source of competitive advantage, compared to 39% in the 2022 survey. For management respondents, the figure was 56%.

Not everyone agrees, however. A minority of respondents said more work is needed to demonstrate how AI is addressing real-world business problems in the industry, says the report.

Top use case: customer experience

When NVIDIA’s survey drilled into the top use cases and need for AI, generative AI (gen AI) rose to the top. Of those respondents investing in AI, 57% are using gen AI to improve customer service and support, 57% are using it to improve employee productivity, 48% are using it for network operations, and 32% are using it for marketing content generation.

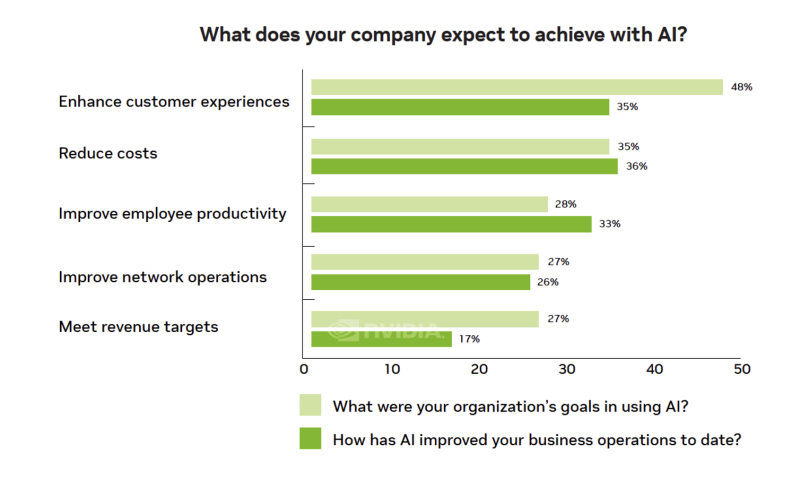

When asked about specific goals, enhancing customer experiences was cited as a big AI opportunity for the industry, with 48% of respondents selecting that goal. Some 35% of respondents identified customer experiences as their key AI success story. Some of the specific uses cases for customer experience include virtual assistance, enriched retail experience, recommendation engines, and management of customer churn.

The survey found that the industry is even developing and deploying its own large language models (LLMs) for gen AI. Forty percent of the respondents said they are using their own data to train their own LLM model, which can be used to augment existing solutions.

Benefits on revenue and cost side

There is a compelling case for AI to help on both sides of the business – both by controlling costs (increased productivity) and by helping boost revenues.

Among all respondents, 67% reported that AI adoption has helped them increase revenues, with 19% of respondents reporting more than 10% growth. For respondents in at least the trial or pilot stage, 71% reported that AI adoption has helped them increase revenues in specific business areas.

On the cost side, 63% of all respondents said AI has helped them reduce costs, with 14% noting the reduction was more than 10%. For those in at least the trial stage, 66% of respondents reported help in reducing costs.

Challenges: skills and investment

Reflecting challenges in other industries, AI’s largest barriers for the telecom industry are likely to be a skills gap and lack of sufficient budget to deploy. A recent survey by Equinix showed that 62% of global decision makers see a skills gap as a threat to their business. In that survey, 42% of IT leaders doubt their ability to accommodate AI. The NVIDIA survey cited the lack of data scientists as critical to this skills gap, with 36% reporting that a lack of data scientists was a concern.

Another barrier, as always, is budget and return on investment (ROI). Business leaders will have to quantify the ROI for AI to gain more budget. But that situation may be improving. In NVIDIA’s 2023 survey, 33% of respondents said they struggle to quantify ROI, which is down from the 46% of respondents in 2022.

Additional challenges include the common ones cited across the industry: lack of sufficient infrastructure, the need for more data, and concerns about privacy.

Overall, these results not only promise a bright future for the survey’s sponsors – AI-industry leading NVIDIA – but they also show a glimmer of hope that AI promises productivity and operations improvements across several vectors of the telecommunications industry.

R. Scott Raynovich is the founder and chief analyst of Futuriom. For more than two decades, he has been covering a wide range of technology as an editor, analyst, and publisher. Most recently, he was VP of research at SDxCentral.com, which acquired his previous technology website, Rayno Report, in 2015. Prior to that, he was the editor in chief of Light Reading, where he worked for nine years. Raynovich has also served as investment editor at Red Herring, where he started the New York bureau and helped build the original Redherring.com website. He has won several industry awards, including an Editor & Publisher award for Best Business Blog, and his analysis has been featured by prominent media outlets including NPR, CNBC, The Wall Street Journal, and the San Jose Mercury News. He can be reached at [email protected]; follow him @rayno.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Wireless staff. They do not necessarily represent the opinions of Fierce Wireless.