-

Nokia struggled onward in Q1 2024 with revenues plunging 20% YoY

-

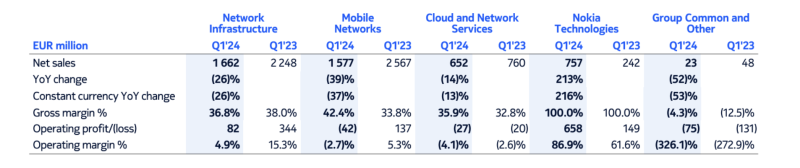

Mobile Networks revenues were especially down

-

The company says things should get better later this year

Nokia saw a 20% year-over-year decline in net sales for its first quarter 2024, reporting €4.67 billion ($4.95 billion) compared to €5.86 billion ($6.24 billion) in the same quarter a year ago.

Nokia CEO Pekka Lundmark said the outlook for Network Infrastructure (NI) for 2024 has improved but that Optical Networks within NI may take somewhat longer. “We expect Network Infrastructure will return to net sales growth for full year 2024 with a stronger second half performance,” said Lundmark.

Mobile Networks was still a hurtin’ unit after a rough 2023. The company said Mobile continued to be impacted by particularly low levels of spending in North America and India, which led to a Q1 net sales decline of 39%.

“Globally, we expect Q1 to mark the low point in demand with activity then progressively picking up through the remainder of 2024 consistent with more normal seasonality,” said Lundmark, in regard to Mobile.

For the breakdown in revenues for each business unit, see the below chart.

Even though there are a lot of negative numbers in the above chart, company executives didn’t say anything about breaking up the company or putting certain assets on the block, although rumors have swirled about such possibilities.

Guidance

For the full year 2024 Nokia is guiding for its Network Infrastructure business revenues to grow 2-8%. But its Mobile revenues are expected to decline 10-15% this year.

The company continues to expect weak profit generation in the first half followed by a “significantly stronger” second half of 2024.

Network Infrastructure

On the company’s earnings call today, Lundmark talked a bit about the growing importance of fiber broadband.

“It’s important to remember that globally, excluding China, over 70% of homes are still not connected by fiber, and there is a significant opportunity remaining in our biggest markets of both North America and Europe,” he said.

He said Nokia was seeing improvements in demand in North America as BEAD progresses, and that will benefit the company in the second half of this year and more meaningfully in 2024.

Mobile Networks

And on Mobile, Lundmark said Q1 was very weak largely because of India. During the first half of 2023, Nokia benefited from “a massive 5G deployment in India,” but now those volumes have normalized, making a tough year-over-year comparison.

Of course, Lundmark was asked about Nokia’s strategy in the U.S. now that AT&T chose Ericsson as its open radio access network (open RAN) vendor.

He said AT&T is still a customer for Nokia equipment (other than open RAN). And Nokia still does business with other U.S. wireless operators.

“In addition to that, there is a growing private wireless business in North America that we are doing with several of our partners,” he said. And he mentioned there's significant potential to win a deal with the “defense industry” to implement 5G into military applications.

He also talked more generally about open RAN.

He said interest in open RAN is gradually increasing. “As you know, we have been, from the beginning, a strong supporter of O-RAN, the strongest contributor to the standard. We have several real customer implementations, commercial implementations underway."

He also mentioned the importance of cloudifying the baseband functions of the mobile network. “This is, of course, a different thing from the open fronthaul interface that O-RAN will bring, but often these two will coexist in the future, and we are equally pleased to be clearly one of the leaders in the cloud RAN development.

Cost cuts

Nokia is in the midst of a cost-cutting initiative where it’s aiming to achieve between €800 million and €1.2 billion in cost savings by 2026. It wants to cut €500 million this year. And of course, cost cutting usually means lots of layoffs.

Today, Lundmark indicated that the company laid off about 2,000 people in Q1 2024. “So, we are in a good, I would say, position to execute the expected cost savings for this year,” he said.