-

Cloud growth is finally back on the upswing after sliding for much of 2023

-

AI is credited with driving a significant amount of momentum

-

Growth rates are expected to continue climbing in Q1 2024

Artificial intelligence (AI) seems to be a sort of Miracle-Gro for the public cloud. Revenue growth rates tumbled dramatically in late 2022 and early 2023 before bottoming out in Q3 2023 thanks primarily to cloud cost optimization efforts. But in Q4, AI brought some green back to the cloud garden.

Analysts at New Street Research noted that public cloud growth is finally back on the upswing, ticking up slightly from an industry average of 19% in Q3 to 20% in Q4. They forecast the industry’s growth rate will continue to rise in Q1 2024, reaching 22%.

“Public Cloud remains a no brainer for the vast majority of use cases, and has plenty of headroom to exceed 10% of IT spending. We expect growth to remain in the 20-30% range for years,” New Street’s team wrote.

All told, Synergy Research Group said global spending on public cloud infrastructure services hit nearly $74 billion in Q4. Even more impressive was the $5.6 billion sequential jump in revenue from Q3.

“In short, this was a banner quarter for the cloud market. The last quarter of the year usually benefits from a seasonal bounce with quarterly spending increasing much more than in the first three quarters, but this quarter set a record,” Synergy Chief Analyst John Dinsdale said in an email.

He added Generative AI is “clearly one of the main reasons for the strong performance.”

Bringing home the cloud bacon

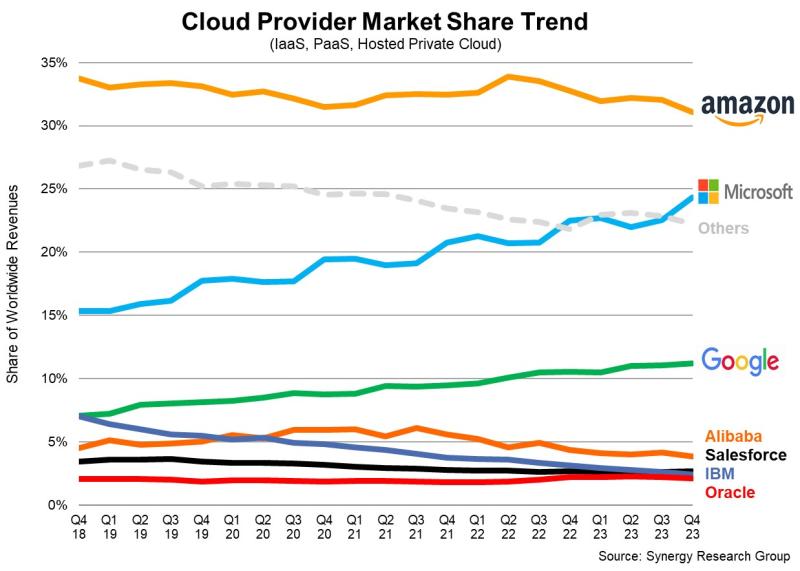

In terms of market share, Synergy’s data showed Microsoft gained the most ground, jumping two points to 24%. Amazon still reigned supreme with 31% market share while Google had 11%. Challengers with less than 5% market share included Alibaba (4%), Salesforce (3%), IBM (2%), Oracle (2%) and Tencent (2%).

Earnings at a glance

Here’s a rundown of highlights from the big three U.S. cloud company earnings reports in case you missed them.

Amazon Web Services

- Amazon Web Services (AWS) revenue jumped 13% year-over-year to $24.2 billion.

- AWS operating income also rose year on year from $5.2 billion to $7.2 billion.

- During earnings, Amazon CEO Andy Jassy noted AWS is “now approaching an annualized revenue run rate of $100 billion.”

- He added “revenues are accelerating rapidly” as customers resume and accelerate existing cloud migration projects that were put on hold in 2023, undertake new initiatives and explore AWS’ generative AI technology.

Google Cloud

- Cloud revenue of $9.2 billion was up 26%, driven in part by AI adoption.

- Segment operating income of $864 million marked a stark turnaround from a loss of $186 million in Q4 2022.

- CFO Ruth Porat said the company expects investment capex in 2024 will be “notably larger” than in 2023.

- She also noted the $11 billion it spent on capex in Q4 largely went to “technical infrastructure” including servers and data centers.

Microsoft

- Consolidated revenue rose 18% to $62 billion, with net income up 33% to $21.9 billion.

- Cloud revenue increased 24% to $33.7 billion, with Azure and other cloud services revenue growing 30%.

- CEO Satya Nadella said during an earnings call the company now has 53,000 Azure AI customers.

- “Overall, we are seeing larger and more strategic Azure deals with an increase in the number of $1 billion plus Azure commitments,” Nadella added.