Ciena and Cisco are reaping the benefits as service providers shift spending from long haul to metro WDM (wave-division multiplexing) network builds.

As a result of double-digit year-over-year North America growth in metro WDM, Cignal Al said in its second-quarter 2017 Optical Hardware Report that that Cisco and Ciena grew market share.

The research firm said that Ciena’s North American optical equipment revenue increased by 21% year-over-year.

Interestingly, the growth in metro WDM spending is creating greater demand for higher speed coherent ports, which are evolving from 200G to speeds as high as 400G later this year.

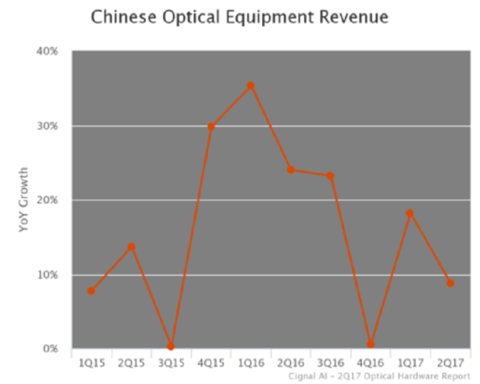

Outside of North America, growth in China is notable as optical revenue rose 13% year-over-year for the first half of 2017. Cignal Al said that the “weak” demand reported by component provides “is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.”

China’s dominant optical players Huawei and ZTE reported record shipments of 100G coherent ports in China during the quarter. The companies also showed strong revenue performance in the region.

Outside of China and Japan, the rest of the Asia-Pacific countries saw 20% year-over-year growth. A key driver of this region’s growth was from India’s Reliance Jio, which is purchasing a large amount of equipment from Ciena and Nokia as part of an aggressive 4G LTE expansion effort.

However, EMEA was a different story as revenue dropped as a result of sharp declines in spending in the long-haul WDM and submarine systems markets. Meanwhile, metro WDM spending remained flat year-over-year.