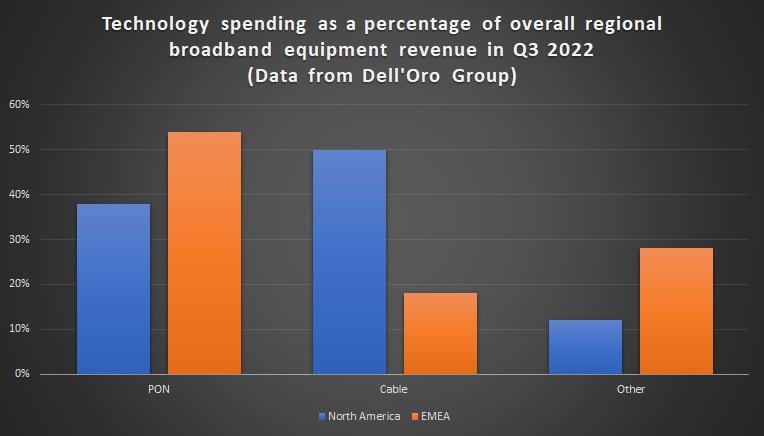

Global PON equipment revenue shot up 27% year on year in Q3 2022, driving overall spending in the broadband equipment market up 17% to $4.7 billion, new data from Dell’Oro Group showed. But in North America, at least, optical technology still wasn’t the primary revenue generator, though you’d be forgiven for thinking otherwise.

Dell’Oro Group VP Jeff Heynen told Fierce about $1.4 billion of broadband equipment revenue in Q3 came from North America. Of that, 50% went to cable equipment while 38% was spent on fiber gear, such as optical network and line terminals. The remainder of revenue came from spending on DSL and fixed wireless access kit.

North America’s decision to stick with cable comes as other areas like Europe shift spending elsewhere. In the EMEA region as a whole, for instance, PON accounted for 54% of overall broadband equipment spending with cable contributing just 18%. The former figure was up from 44% in Q3 2021, while the latter was down from 20%. Growth in PON spending as a percentage of overall broadband equipment revenue in North America has been noticeably slower – rising from 32% to the aforementioned 38% over the same period – and the decline in cable less severe.

Heynen said he believes the downward slide in North America will reverse course with the advent of DOCSIS 4.0, but doesn't think the same will happen in EMEA.

Zooming in a bit on cable CPE, Heynen noted unit shipments rose around 5% year on year to 8.7 million in Q3. Approximately 75% of those went to North America, he added. In contrast, “the European market has shown a bit of a decline. It used to be around 20% of the market and now it’s around 16%,” he said. “Even on the CCAP side, you can see that that’s happening. The share of CCAP channels, for example, in North America is still around 65%. Europe is 25%.”

In terms of what cable kit folks around the world are buying, Heynen noted DOCSIS 3.1 gear accounts for around 82% of CPE shipments. He added Remote PHY devices set records for revenue and units shipped for the fifth consecutive quarter, reflecting “steady purchasing and proliferation” of distributed access architecture.

DSL death

Heynen also highlighted another interesting metric which hints at extensive fiber overbuilding in addition to greenfield builds: the slow death of DSL spending. Two years ago, the number of DSL ports shipped was 22.3 million. That figure is expected to plummet to 7.5 million in 2022, he said, with “nearly all” of those going to Europe.

“That’s a sizable decline over two years and what that says to me is those operators that had DSL and relied on it, they’re not investing in new infrastructure and that must mean they’re clearly overbuilding infrastructure with fiber at this point.”