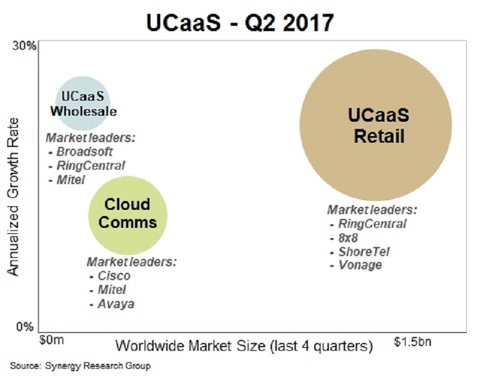

RingCentral has taken the lead in terms of quarterly revenues and subscriber counts in the competitive Unified Communications as a Service (UCaaS) market, followed by 8x8, Mitel, Broadsoft, and Vonage. It's a market that is rapidly approaching $2 billion annually.

As enterprises look towards migrating to the cloud, UCaaS has become part of an equation that Synergy Research says is accelerating at an annualized rate of 29%.

As strong UCaaS adoption continues to drive the market, retail UCaaS services account for well over 80% of the total market, though the research firm said that smaller wholesale UCaaS segment is growing considerably stronger at 45%.

RELATED: 8X8, Vonage take hold of UCaaS market, says research firm

Making up 81% of second-quarter 2017 total revenues, the UCaaS market continues to be heavily concentrated in the United States, followed by the United Kingdom and Germany.

According to Synergy, UCaaS is defined as a service where service providers host and develop proprietary Cloud PBX platforms, enabling PSTN connectivity and offering an integrated UC application stack with services like conferencing, team collaboration and IM&P.

Service providers that use third-party call control including technology such as Broadsoft Roadworks or Cisco HCS are defined by Synergy as Hosted PBX.