Fueled by both public and private investment, North America has been the fastest growing region over the last two years for PON equipment used to deliver residential fiber broadband services. Total spending by service providers on PON equipment in the region has grown from $774M in 2019 to an expected $1.9B in 2022. Service providers of all sizes continue to expand on their initial goals of passing homes with fiber as they overbuild legacy DSL footprints while seeking to leapfrog cable operators which have dominated the broadband market in the region for years. Indeed in many cases, one of the primary reasons for the heavy focus on fiber was the dramatic loss of DSL subscribers to cable during 2020 and 2021, as subscribers’ bandwidth requirements easily exceeded what ADSL2+ and VDSL technologies could provide.

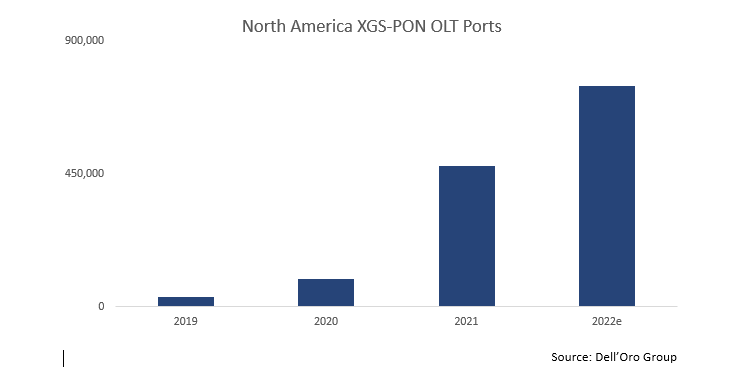

The concern regarding speeds and long-term competitiveness has led to another unique development in the North American market: The meteoric rise of XGS-PON as the primary technology used in new FTTH network buildouts. Between 2019 and 2022, XGS-PON OLT port shipments have increased 2231%, jumping from 32k in 2019 to an expected 748k in 2022. It’s likely the numbers in 2022 would be even higher were it not for the lingering supply chain issues that have resulted in considerable vendor backlogs.

While tier 1 operators such as AT&T and Frontier Communications constitute the bulk of these shipments, it’s important to note that XGS-PON is being deployed by operators of all shapes and sizes, including electric co-ops, rural operators and tier 3 telcos and cable operators. In fact, after many informal conversations with these smaller, community-focused operators, it’s difficult to find one that hasn’t already deployed some XGS-PON or is in the process of building out new fiber networks that will rely on XGS-PON from the outset.

Obviously, service providers are focused on maximizing their investments and ensuring the long-term success of their expansive—and expensive—fiber buildouts. So, it’s no surprise that XGS-PON has quickly become the technology of choice for the vast majority of North American fiber providers. In fact, we have already reached the point where XGS-PON OLT port shipments are surpassing GPON OLT port shipments. That occurred back in 3Q21 and has not changed since.

ONT units are a slightly different story, with XGS-PON unit shipments still lagging behind GPON units on a quarterly basis. This is due largely to the embedded base of GPON networks, as well as to supply chain constraints that have limited the availability of new, cost-reduced XGS units.

Service providers clearly believe that the multi-gig symmetric services XGS-PON can deliver are now table stakes for them. In many cases, symmetric 1Gbps services are considered the lowest service tier, with symmetric 2Gbps and 5Gbps quickly becoming the mid- and high-level service tiers. Already, Bell Canada is offering a symmetric 8Gbps service tier, with Google Fiber planning to add both a 5Gbps and 8Gbps tier in 2023. Many more will follow, as the great fiber expansion in North America transitions to the great speed war.

The focus on speed and the need to stay ahead of competitors will likely result in an accelerated adoption of new PON technologies in North America, including 25Gbps and 100Gbps PON. It might seem crazy to think that service providers would move so quickly from a shared subscriber capacity of 10Gbps per OLT port. But if providers are already pushing 5Gbps and 8Gbps tiers, they are going to quickly exhaust their XGS-PON capacity, even with oversubscription. The likely scenario is that take rates for these high-end services end up being relatively modest in the short-term, as the bulk of subscribers stick with 500Mbps to 1Gbps service tiers. That leaves plenty of headway for XGS-PON through at least 2030, which matches the typical life cycle of a PON technology.

But speed is ultimately just one aspect of a successful broadband service. Whether it’s through the addition of new residential service tiers based on new parameters such as latency, jitter and upstream speed or whether it’s expanding their largely residential networks to enterprise and wholesale mobile backhaul services, operators are going to have to find a way to differentiate their fiber networks and services quickly.

This is where the ability to provision and deliver new services that are specifically targeted to address how customers use bandwidth will become a critical component for successful broadband service providers. Whether it’s home security, cybersecurity, parental controls or bandwidth prioritization by application or traffic, successful providers will have to complement the higher speeds they offer with applications and beneficial services that allow customers to take full advantage of their subscriptions.

With the immense fiber buildout currently occurring in North America and its reliance on XGS-PON and ability to deliver 10Gbps speeds, the focus for service providers in the second half of this decade will be squarely on how to maximize their investments and how to cement subscriber relationships with services and support that go well beyond what is offered today.

Jeff Heynen joined Dell’Oro Group in 2018, and is responsible for the Broadband Access and Home Networking market, Fixed Wireless Infrastructure and CPE market research programs. He has expanded the Broadband Access and Home Networking areas to include fixed wireless CPE, virtual CCAP, Remote PHY, Remote MACPHY and DOCSIS 4.0 infrastructure. Heynen is a frequent judge and expert speaker at industry conferences and his research and analysis have been widely cited in leading trade and business publications.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceTelecom staff. They do not represent the opinions of FierceTelecom.