-

Verizon reported 158,000 wireless retail postpaid phone net losses in Q1 2024

-

Overall in prepaid, the consumer group reported 216,000 wireless retail net losses in Q1

-

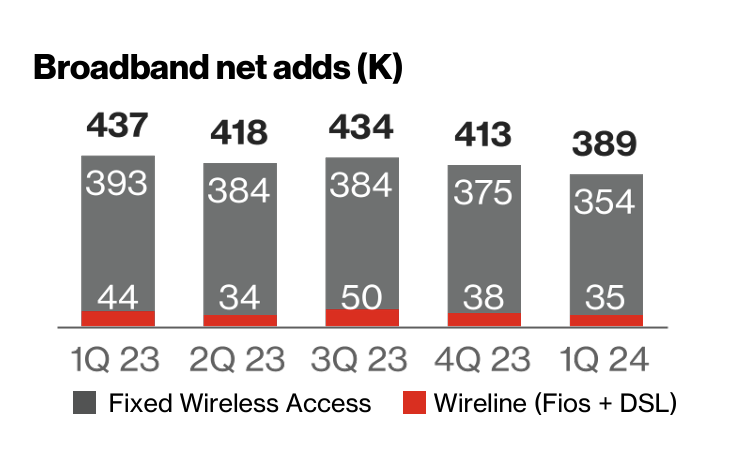

The company reported total broadband net additions of 389,000 during Q1

The good news is Verizon reported fewer quarterly subscriber losses in its consumer division thanks in part to MyPlan and streaming services. The bad news is it’s still got a way to go to shore up losses in its postpaid and especially prepaid wireless divisions.

The consumer division reported 158,000 wireless retail postpaid phone net losses, which is an improvement of 105,000 from the Q1 2023 net losses of 263,000. Verizon said it represents the consumer division’s best first-quarter performance since 2018.

Total wireless service revenue in Q1 2024 was $19.5 billion, up 3.3%, driven by price hikes in recent quarters, more customers selecting the higher premium price plans and growth of the fixed wireless acces (FWA) subscriber base.

Capital expenditures in Q1 were $4.4 billion, a rather stark decrease compared to the $6 billion in the year-ago quarter.

The business division reported 178,000 wireless retail post net additions in Q1 2024, including 90,000 postpaid phone net additions and 151,000 net FWA adds.

Overall, Verizon gained 354,000 net FWA additions in Q1, bringing its FWA base to 3.4 million.

Impact of ACP expiring

Verizon’s prepaid customer base includes 1.1 million customers who are in the Affordable Connectivity Program (ACP), a Covid-inspired program to help low-income people get connectivity. Without further funding from Congress, the plan is expected to go away in May.

Verizon CFO Tony Skiadas said the company has plans underway for retention and potential acquisition opportunities as that program winds down.

In a report today, analysts at New Street Research said they don’t expect the impact of ACP ending to be very material for the Big Three wireless carriers, with Verizon likely to be the least affected within the group, although “uncertainty around the fallout may keep investors on the sidelines for another few quarters.”

Overall in prepaid, the consumer group reported 216,000 wireless retail net losses in Q1, which is better than the 351,000 subscriber losses a year ago. Excluding SafeLink Wireless, which is Verizon’s brand that offers access via government-sponsored programs, wireless retail prepaid net losses were 131,000.

Craig Moffett of MoffettNathanson called Verizon’s prepaid group “an unmitigated disaster … and that’s before ACP funding runs out in just a few weeks.”

Just over half of all ACP subscriptions are for mobile phone service, not home broadband, he noted.

During the earnings conference call, Hans Vestberg, CEO Verizon Wireless, was asked if the consumer postpaid subscriber adds would turn positive in the second quarter. He reiterated that he thinks it will turn positive in 2024 but didn’t commit to it happening in Q2.

Vestberg also highlighted growth in the private networks business, saying it has long-term contracts with partners around the world.

Broadband

The company reported total broadband net additions of 389,000 during Q1, composed of the 354,000 FWA additions, 53,000 Fios net adds and a decrease of 18,000 DSL lines.

The company says it now counts 11.1 million total broadband subscribers as of the end of first-quarter 2024, including the above-mentioned 3.4 million FWA subs.

Fixed wireless revenue for the first-quarter 2024 was $452 million, up $197 million compared to the prior year period.

Perhaps the most interesting commentary in regard to fixed broadband came after an analyst asked if Verizon would jump into the open access network game.

It’s been a new trend in broadband for companies to deploy open access fiber networks. Once deployed, these networks can be leased to several internet service providers to compete for end customers. The benefit is that the fiber only needs to be deployed once, cutting down on major costs and disruptions to neighborhoods.

AT&T’s joint venture with BlackRock is an open access initiative. And even T-Mobile is getting in on open access, building these types of networks with a number of vendors.

Today Vestberg said, “We haven’t done any open access so you can see our appetite hasn’t been that big.”

But he said Verizon is always evaluating opportunities. “So far in this environment with the very high costs of capital investments, we haven’t found a good return on investment on it," he said. "We are very financially prudent, and remember we have our fixed wireless access. We have our FiOS. That doesn’t mean I’m not going to look into other models. But right now there have not been any models that are appealing to me and the team and for our shareholders.”

Yes! to AI

Vestberg didn’t miss an opportunity to talk about artificial intelligence (AI), the buzzword of the year.

Of course, Verizon has been working with AI for several years. It’s been using AI to drive optimization of internal processes, including in the network and customer service, and it’s establishing an AI-based revenue stream by commercializing Mobile Edge Compute (MEC) capabilities. Last year, it released a set of AI guiding principles to establish itself as a leading and trustworthy source.

“We see a great opportunity with AI to serve our customers better,” he said. “We’re already using for example personalization in MyPlan with AI and we are using it in our network when it comes to performance or the capacity deployed” as well as power consumption.

He also stressed the revenue opportunities. “We are using AI and Generative AI already commercially … Our network was built for AI,” including via the creation of Verizon Intelligent Edge five or six years ago, with compute and storage at the edge. “AI is sort of built for that, with the low latency that we have on the 5G network.”