Industry Voices are op-eds from industry experts or analysts invited to contribute by Fierce staff. They do not represent the opinions of Fierce.

Can AI rescue everything? Not likely. It’s likely to have an outsized benefits for cloud providers, while the upside for service providers may be limited to automation and reducing costs with AI operations (AIOps), as we covered here in February.

A review of financial numbers and growth trends across both service providers and service providers shows that aggregate capital spending (capex) investment is slowing across the board and the center of gravity of infrastructure continues to shift toward the cloud providers.

The cloud providers have enough funding to grow infrastructure and services — as well as invest in artificial intelligence (AI) — while the data shows that service providers continue to retrench by cutting overall capital investment. To make things worse, services revenues for service providers have declined, giving them less resources to invest.

This positions the cloud providers better to take advantage of the AI boom, because they have more paths to monetizing AI services and infrastructure. The telcos remain in in a rough spot. They’ve overpromised on 5G, accumulated loads of debt building out infrastructure, and haven’t shown any growth in services. The suffering has been borne out in their financials and share prices.

Without AI, the market would be toast

But is that all? Can the AI help? The technology and communications markets would be in rough shape without the AI boom, which has supplied underlying demand for communications and infrastructure. The numbers and analysis from Futuriom’s Cloud Tracker Pro service show that AI has simply replaced losses in other infrastructure spending, rather than add to it.

The leading public cloud service providers, while also feeling the macroeconomic pinch and lowering their capex relative to former years, are ramping up spending on AI infrastructure. Their goal is to offer customers, including leading AI startups, the means to leverage the public cloud platforms to train large language models (LLMs) and develop applications from them. To this end, cloud hyperscalers have been trimming other budgets to support their AI goals.

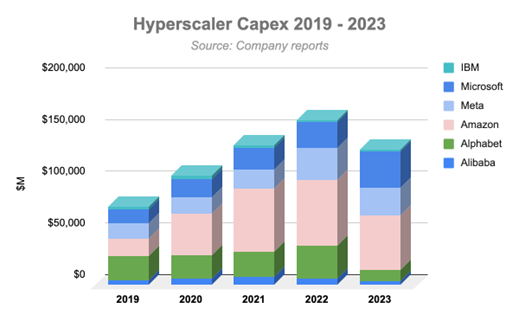

As seen below, you can see the ramp in cloud infrastructure from the COVID boom, followed by a pullback in spending even with AI, as measured by overall capex investment at the major cloud providers we track. Aggregate capital spending peaked at just over $150 billion in 2022, declining in 2023 and 2024.

(Note, Oracle reports on different cycles from the other cloud providers, so we broke Oracle’s capex separately in our analysis. We have included Oracle’s revenues below.)

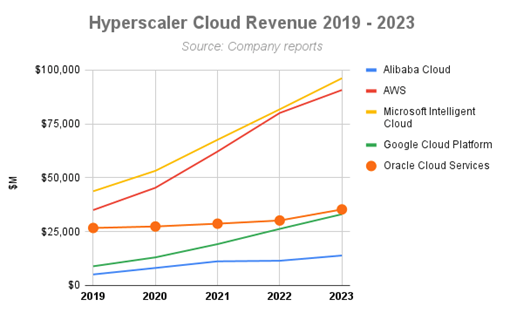

Even with less capex spending, however, cloud services revenue continues to grow robustly. When you compare a set of the leading hyperscaler cloud services revenues, you can see in the chart below that they continue to grow consistently.

The situation is entirely different for the telcos. Revenue growth is stagnant, costs are rising, and share prices are down. Particularly painful is the lack of uptick in private 5G, which has failed to compensate for the loss of business wireline access and wholesale business connections. The best the telcos can seem to count on is a bump in bandwidth demand and cost optimization using AIOps.

AT&T, for instance, saw its Business Wireline revenues fall -7.3% for 2023 compared to the prior year, and the long-ailing segment’s operating income fell -43.7%.

“We expect legacy Business Wireline declines to be partially offset by incremental cost savings and increased fiber and fixed wireless revenues [in 2024],” said Pascal Desroches, AT&T EVP and CFO, on the company’s year-end earnings call January 24, 2024.

Verizon Business also saw revenues reduced -3.6% year-over-year at the end of 2023. The division contains Verizon’s IoT, edge solutions, private 5G and managed network services (including SD-WAN and a recently introduced multi-cloud and hybrid-cloud management offering). The group was devalued in Verizon’s accounting by $5.8 billion last year. It has also had a leadership change, with Kyle Malady replacing Sowmayanarayan Sampath in March 2023 as EVP and CEO of Verizon Business Group. (Sampath moved on to become EVP and CEO of Verizon’s Consumer Group.)

Our research shows that in a basket of major telcos that we track, most are decreasing their capex in aggregate, as seen in the table below. Telefonica, Verizon and Orange are all decreasing capex spending for 2024. AT&T is the only major service provider projecting an increase.

| Company | 2023 | 2024 Guidance |

| AT&T |

$17,853 |

$21 billion to $22 billion |

| Deutsche Telekom |

$19,381 |

Flat y/y |

| Orange |

$8,493 |

N/A |

| T-Mobile |

$9,801 |

$8 billion to $9.4 billion |

| Telefonica SA |

$6,347 |

Flat y/y |

| Verizon |

$18,767 |

$17 billion to $17.5 billion |

Bottom line: AI has boosted cloud, but less so telco

The bottom line of all this is that long-term trends remain in place. Cloud providers are stealing infrastructure and revenue share from the service providers. Enterprise data, services and even communications continue to move toward cloud infrastructure.

If the service providers can’t afford to build and improve their equipment plant, they don’t have much hope of altering this trend. The telcos have seen their services footprint in enterprise erode, and this is turning into a death spiral as they have less money to invest in infrastructure.

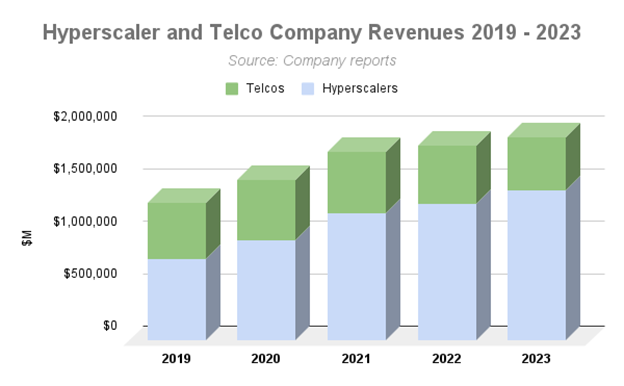

As you can see below, the share of market as reflected in revenues is increasing for hyperscalers, while decreasing for telcos. The hyperscalers we track (IBM, Microsoft, Meta, Amazon, Alphabet and Alibaba) have increased their collective revenue from $775 million in 2019 to $1.4 trillion in 2023, an 80% increase. Total telco services revenue from the leaders we track (AT&T, Deutsche Telekom, Orange, T-Mobile US, Telefonica SA and Verizon) has shrunk from $542 billion to $505 billion.

In other words, service providers continue to lose market share, whether that’s viewed from the consumer or enterprise world. They continue to lose importance.

With the services upside limited for service providers and capital spending down, the focus will have to be on automation and cost cutting.

R. Scott Raynovich is the founder and chief analyst of Futuriom. For more than two decades, he has been covering a wide range of technology as an editor, analyst, and publisher. Most recently, he was VP of research at SDxCentral.com, which acquired his previous technology website, Rayno Report, in 2015. Prior to that, he was the editor in chief of Light Reading, where he worked for nine years. Raynovich has also served as investment editor at Red Herring, where he started the New York bureau and helped build the original Redherring.com website. He has won several industry awards, including an Editor & Publisher award for Best Business Blog, and his analysis has been featured by prominent media outlets including NPR, CNBC, The Wall Street Journal, and the San Jose Mercury News. He can be reached at [email protected]; follow him @rayno.